Bank of America Merrill Lynch FX Strategy Research notes that USD investors are focusing squarely on the potential of US corporate income tax reform.

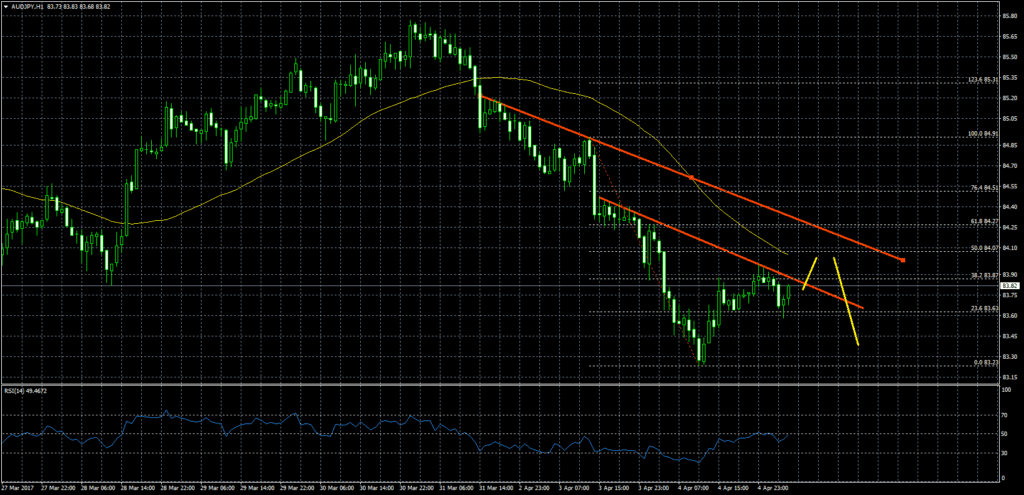

"Developments in US fiscal policy will continue to play a major role in driving both overall market sentiment as well as the USD," BofAML argues.

On the Fed front, BofAML's base case is that Federal Reserve’s rate hike in March is likely to be followed by two more this year, leaving the USD with an interest rate advantage over other countries.

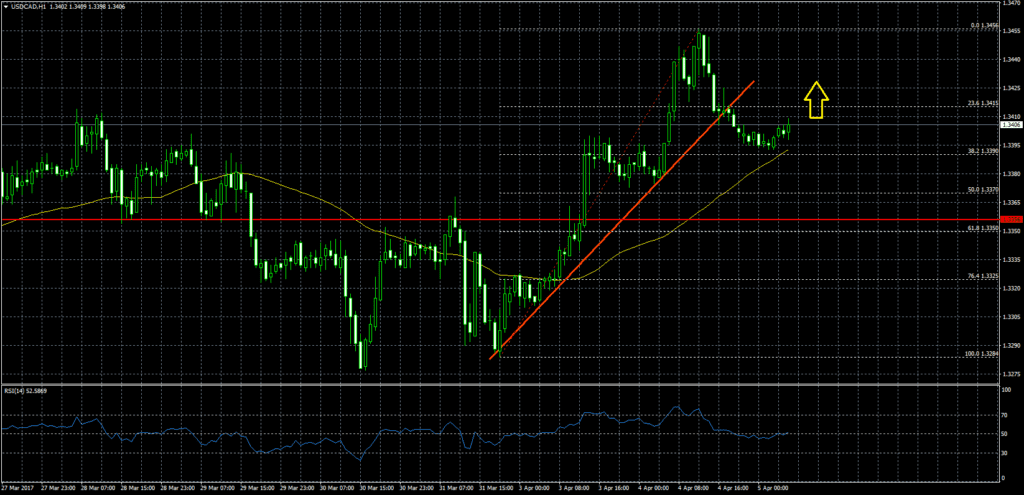

As such, BofAML continues to be relatively more USD positive, despite some modest recent softening.

Source: Bank of America Merrill Lynch Rates and Currencies ResearchOriginal Article