Key Points

- The US Dollar after a dip towards 1.3400 against the Canadian dollar found buyers and once again moving higher.

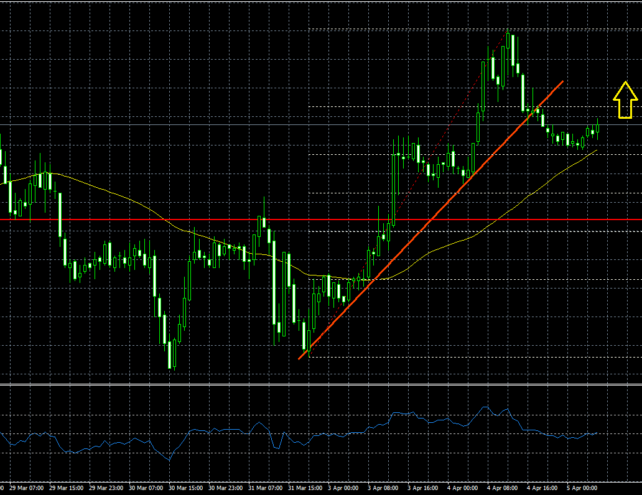

- During the recent downside, there was a break below a bullish trend line with support at 1.3420 on the hourly chart of USDCAD.

- Today in the US, the ADP Employment Change for March 2017 will be released by the Automatic Data Processing, Inc.

- The market is expecting a change of 187K in March 2017, less than the last 298K.

USDCAD Technical Analysis

The US Dollar after trading as high as 1.3456 against the Canadian dollar started a correction, and moved down. It traded below the 23.6% Fib retracement level of the last leg from the 1.3284 low to 1.3456 high.

There was even a move below a bullish trend line with support at 1.3420 on the hourly chart of USDCAD. However, the pair found support near the 38.2% Fib retracement level of the last leg from the 1.3284 low to 1.3456 high at 1.3390.

The 1.3390 support area was also near the 21 hourly simple moving average, which means 1.3400-1.3390 is a major support and the pair may bounce soon.

US Factory Orders

Recently in the US, the Factory orders for Feb 2017 was released by the US Census Bureau. The market was expecting the total orders of durable and non-durable goods to increase by 1% in Feb 2017, compared with the previous month.

The outcome was in line with the forecast, as the Factory orders increased 1%, which was less than the last revised reading of 1.5%. The report added that “New orders for manufactured durable goods in February increased $3.9 billion or 1.7 percent to $235.4 Billion. This increase, up two consecutive months, followed a 2.3 percent January increase“.

Overall, the USDCAD pair remains supported above 1.3390, and may continue to head higher in the near term.