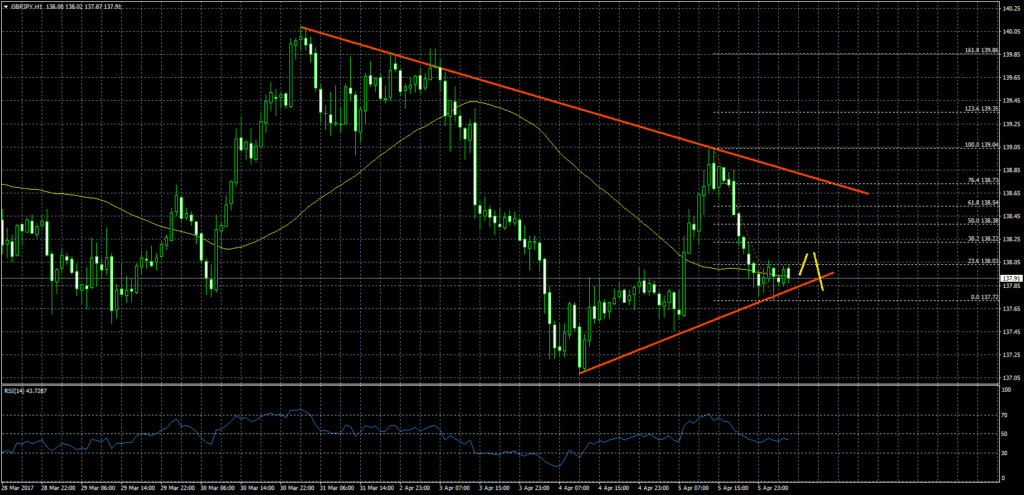

The safe-haven yen climbed against its major rivals, up to a one-week high against the dollar and a 4-1/2 month peak against the euro on Tuesday. Forex investors grew concerned about a possibly tense meeting between U.S. President Donald Trump and Chinese President Xi Jinping.

During his presidential campaign, Trump vowed to label China a currency manipulator on his first day in office.

Markets were nervous following the bombing of a St. Petersburg metro on Monday. U.S. employment data later this week and France's presidential election later this month also weighed on risk appetite.

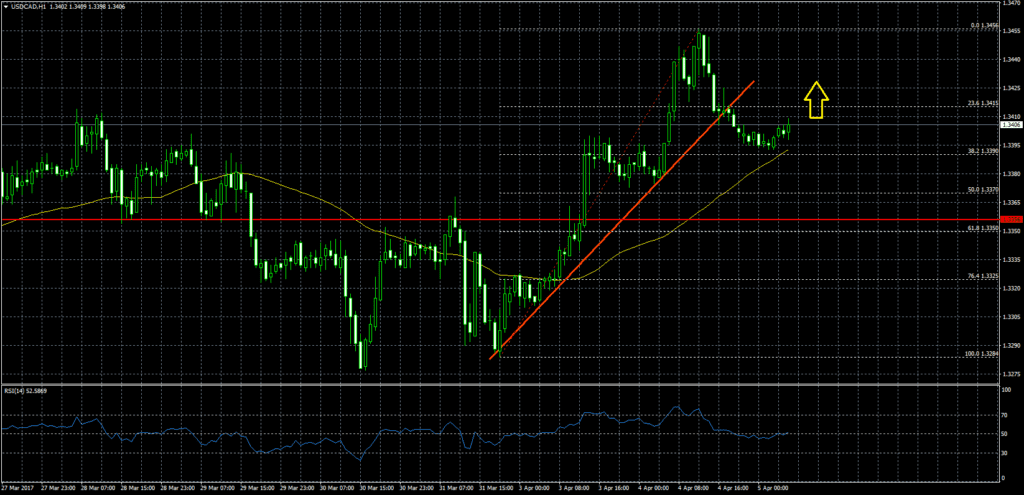

In late morning trading, USD/JPY slipped to 110.26, down to a one-week low.

Economic data on Tuesday was mostly dollar positive. The U.S. trade deficit shrunk more than expected to $43.6 billion in February, a number that could boost first-quarter growth.

U.S. factory orders in February also rose 0.1 percent, expanding for a third straight month.

The single currency, bounced back against the yen, after a sharp drop early on Tuesday. EUR/JPY was down to 117.43, the lowest since Nov. 22 but close above 118.

EUR/USD was down to 1.0634 but rose to 1.0680 following the French presidential debate.

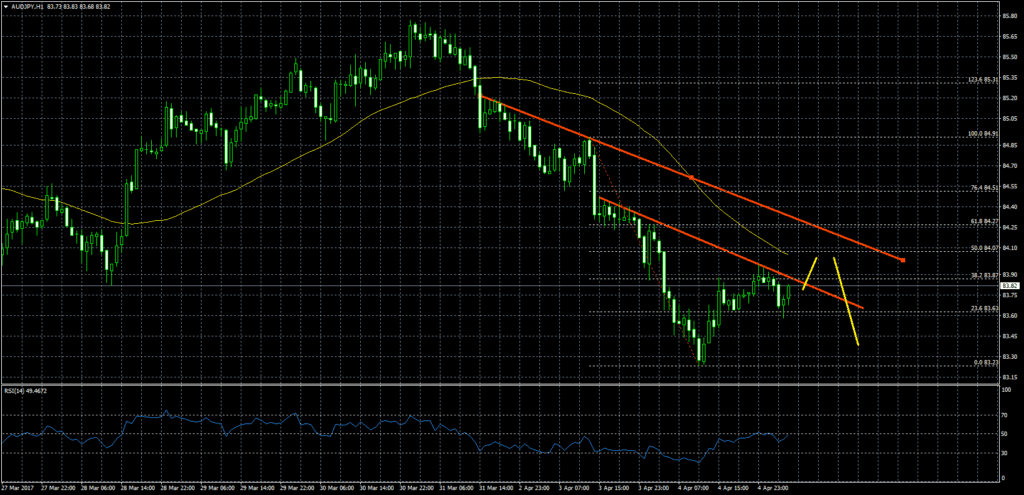

Meanwhile, the Reserve Bank of Australia's decided to leave interest rates at a record low of 1.5 percent. The decision was no surprise but the Aussie dollar fell after the RBA hinted it was not too confident about domestic labor and inflation conditions.

AUD/USD slipped to hit a three-week low of 0.7545. It has been retreating steadily for the past two weeks from a four-month high of 0.7750.