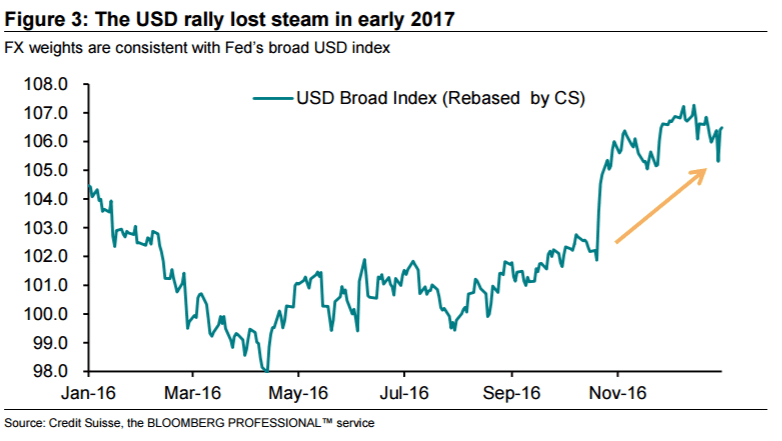

Today is the day that president-elect Trump officially takes the helm as President of the United States with the Presidential Inauguration scheduled for today at 1500hrs CET. It has not been a week of celebration however for the US Dollar, because the US Dollar index is lower for the week. The index, measuring the strength of the Dollar against a basket of currencies, is also lower since year’s start. The index is currently attacking 101 levels to the lower side.

Originally the USD celebrated Trump on news of his election as people awaited more support to the economy – however it seems the honey moon may already be over. In reality Investors await more details of his intended policy before pushing in any direction.

USDJPY is sitting on its 50 DMA at 114.66, and so far although marginally it is the JPY which is in the lead as the currency pair tends lower.

Euro continues its ascent after the ECB held policy steady yesterday, with the EURUSD managing to create some significant space from 1.0340 hit on the 3rd January. The currency pair is currently at 1.0674. Draghi highlighted the need of further monetary policy in the midst of sagging inflation.

As a preliminary gauge of sentiment, Asian markets were mixed this morning. Chinese GDP reported earlier today showed that Y/Y GDP growth for the last quarter of 2016 was better than expected at 6.8%.