When AUD/USD was sub-0.72 and falling in the last week of December, there would have been very few (any?) takers for a bet the pair would be back above 0.75 before the second week of January was out. One of the oldest adages in the FX market playback is that ‘it always looks most offered at the bottom’. Still very wise words.

The biggest issue we have been grappling with in recent weeks with respect to the AUD has been the estimated deviation from our short term fair value model (STFV) estimate that calculates fair favour in relation to oneyear rates differentials, key commodity export prices and risk appetite. This has run consistently between about 0.7550 and 0.77 since Trump’s election victory and for much of the time more than 1 standard deviation (~2.5 cents) above spot. Our sense has been that markets have been applying a discount to the AUD based on its enduring high correlation with Asian EM currencies and where CNY comprises over 40% of the ADXY basket.

AUD remains the preferred, liquid proxy-hedge against Asia EM weakness. Fears that the start of 2017 would see intensification of pressure on CNY from capital outflows once the clock re-set on the $50,000 annual limit on households FX purchases, together with concerns over heighted protectionism directed at China from the new Trump administration, look to have undermined AUD relative to our STFV estimate.

Fast forward to early 2017, and the combination of a dramatic squeeze on short offshore (CNH) positioning combined with seemingly successful efforts by China to throw sand in the gears of Chinese capital outflows, has seen AUD come roaring back. To be sure, broad-based USD selling has been part of the story. But we’d note that the AUD TWI has rallied by 2.5% this far in 2015, much more than implied by the rise in AUD/USD of about 5%. The USD weight in the AUD TWI is only 11.5% and AUD has been by far the best performing currency YTD.

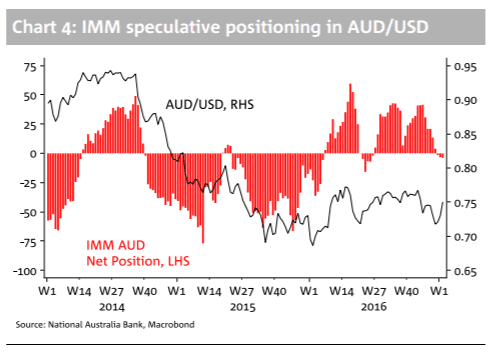

As such, the discount being applied to the AUD for China/EM risk has been dissipating. This looks like allowing AUD/USD to trade close to fair value near term, though we’re not expecting the pair to push much above 0.7500 for a sustained period in the absence of a much deeper purge of long USD positioning (but which in the case of AUD/USD is now close to flat.

Copyright © 2017 NAB, eFXnews™Original Article