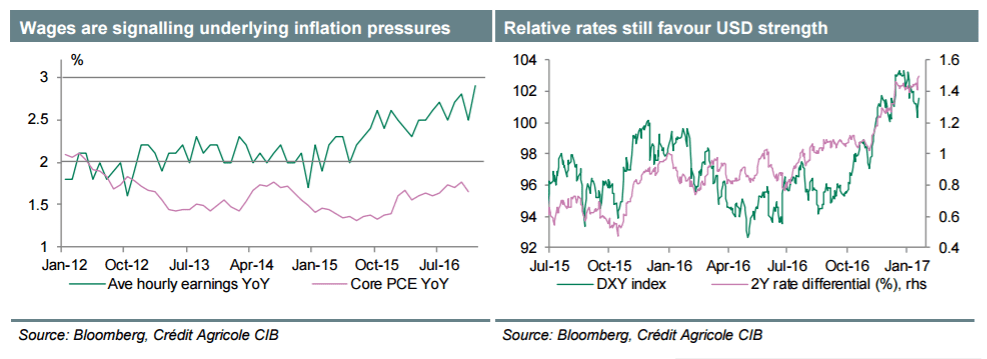

Eurozone inflation is being driven largely by energy costs and the recent pick up in momentum is unlikely to sustain, European Central Bank President Mario Draghi said Thursday, adding that policymakers will continue to look through transient changes.

"There are no signs yet of a convincing upward trend in underlying inflation," Draghi said in Frankfurt in the introductory statement to his customary post-decision press conference.

Headline inflation is likely to pick up further in the near term, on the back of higher energy prices, the ECB Chief said. However, underlying inflation is expected to rise more gradually over the medium term, supported by monetary policy, the economic recovery and the corresponding gradual absorption of slack, he added.

Inflation surged to 1.1 percent in December, the highest level since September 2013, driven by rising energy costs. Core inflation that excludes energy, food, alcohol and tobacco, rose only slightly to 0.9 percent.

The ECB aims for inflation "below, but close to 2 percent".

"The Governing Council will continue to look through changes in HICP inflation if judged to be transient and to have no implication for the medium-term outlook for price stability," Draghi said.

He also stressed that convergence on inflation target must be durable, sustained and visible across the euro area over a medium term. Draghi said that the risk of deflation in the euro area has largely disappeared.

The ECB Chief's remarks led the euro lower against major currencies.

Earlier on Thursday, the Governing Council left all its three interest rates unchanged. The main refi rate was kept unchanged at a record low zero percent and the deposit rate at -0.40 percent. The marginal lending facility rate was held at 0.25 percent.

"The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases," the ECB said in a statement.

The bank also retained its asset purchases of EUR 80 billion a month till March and to continue them at a reduced size of EUR 60 billion a month till December 2017.

Asset purchases can be extended beyond December if necessary, until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim, the ECB added.

"If the outlook becomes less favorable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, we stand ready to increase our asset purchase programme in terms of size and/or duration," Draghi said.

Responding to reporters' questions, Draghi said the Governing Council unanimously agreed that the policy stance in December was appropriate to help in securing a sustained convergence of inflation to the ECB target.

He also said that policymakers did not discuss tapering, or scaling back of stimulus, in the latest meeting nor in the December session.

Draghi pointed out that there was a need for a deep and careful analysis of the economic situation to consider if tapering was warranted. He quickly added that "we are not there yet".

While euro area economic recovery is expected to firm further going forward, the bank said growth will be dampened by a sluggish pace of implementation of structural reforms and remaining balance sheet adjustments.

The risks surrounding the euro area growth outlook remain tilted to the downside and relate predominantly to global factors, Draghi said.

The implementation of structural reforms needs to be substantially stepped up, Draghi stressed, adding that these were necessary in all euro area countries.

Regarding the U.S. President-elect Donald Trump's stance on the global economy and the euro, Draghi said it was too early to comment on his statements. The ECB President adopted the same stance when quizzed about the possible economic impact of the "Brexit" negotiations.

Exchange rate was not a policy target, but important for growth and price stability, Draghi reiterated. He also drew attention to the global consensus that countries should avoid indulging in competitive devaluations of currencies.

When asked about the German opposition towards the ECB's expansionary stance, Draghi said it was in everyone's, including German's interest that the euro area recovery continues. He sought patience, saying that real rates will go up when recovery firms.

"Low interest rates are necessary now to get higher rates in future," Draghi said.

The ECB President also said that the central bank has proven that it can act independently and that it was bound only by the mandate to keep medium term inflation 'below, but close to 2 percent'.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News