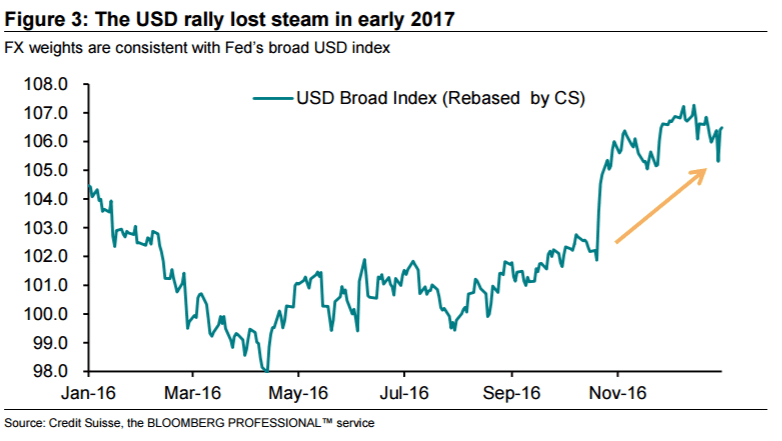

Today’s US presidential inauguration marks an important date for the FX market. In the period between the US election and today’s inauguration, the USD has rallied about 4% against the broad FX basket on hopes of a broad reflation trend, largely in line with the selloff in rates and the rally in risk assets. Inauguration will mark a shift in market focus from policy expectations to policy decisions and implementation. While the balance of expectations remains overall in favor of further USD strength, as detailed in the 2017 Global Outlook, we note that some of the tail risks we first highlighted in the Outlook have become more prominent in the past three weeks.

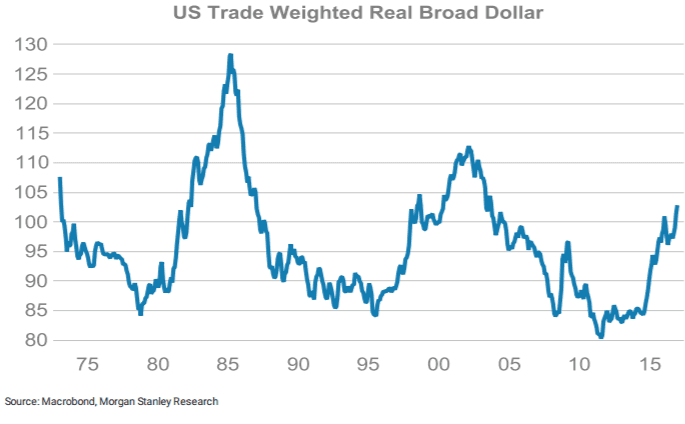

Specifically, last weekend’s comments by President Trump referencing dollar valuation are an important development. Although it was mostly aimed at the USDCNY rate, the idea of US political intervention in FX markets introduces a new (inasmuch as it's not been seen since the 1980s) and unpredictable element for the market to absorb. Similarly, US Treasury Secretary Mnuchin in his Senate confirmation talks stated that “there may be times when the dollar is too strong,” suggesting that the administration might not be completely averse to occasional verbal intervention.

Where does this leave our forecast profile? Since the December FOMC, we have had a kinked profile for the USDJPY forecast, targeting 122 in 3m and 112 in 12m. We wanted to express a view that while the current was in favor of USD strength continuing while there was limited adverse news flow, over a long-term horizon we saw enough risk of negatives like missed growth forecasts and trade protectionism arising to make USDJPY a sell on moves above 120. As it happens, USDJPY never quite made it to that level, and in response to some of these negatives materializing more quickly than the 3- to12-month horizon we had originally expected, the pair has already moved to around 113.

For now, we have decided to keep our 12-month target unchanged at 112. But we acknowledged the fact that the risks are more two-way near term too by lowering our 3m forecast to 115.

Our view now is that a renewed focus at some point in the next three months on Fed rate hikes will allow USDJPY to rally again, and we recommend buying on dips towards 110. But beyond that horizon, the likelihood rises that protectionism and related negatives keep the pair suppressed. To underline this, we note that over the weekend former MOF official Yamasaki said it is "amazing" that Trump so far has said nothing on the JPY. A more direct message would have material implications for USDJPY.

As a technical-based, CS is long USD/JPY from 113.13. *This trade is recorded in eFXplus Orders.

CS FX Targets last updated in eFXplus Forecasts on Jan 18.

Copyright © 2017 Credit Suisse, eFXnews™Original Article