Key Points

- The Euro remained in a solid downtrend and moved below the 1.0680 support vs the US Dollar.

- There are two bearish trend lines formed with resistance at 1.0675 on the hourly chart of EURUSD.

- In the Euro Zone today, the Spanish Unemployment Change for March 2017 was released by the Spanish Government.

- The result was above the forecast, as the change was -48.6K, compared with the forecast of -41.2K.

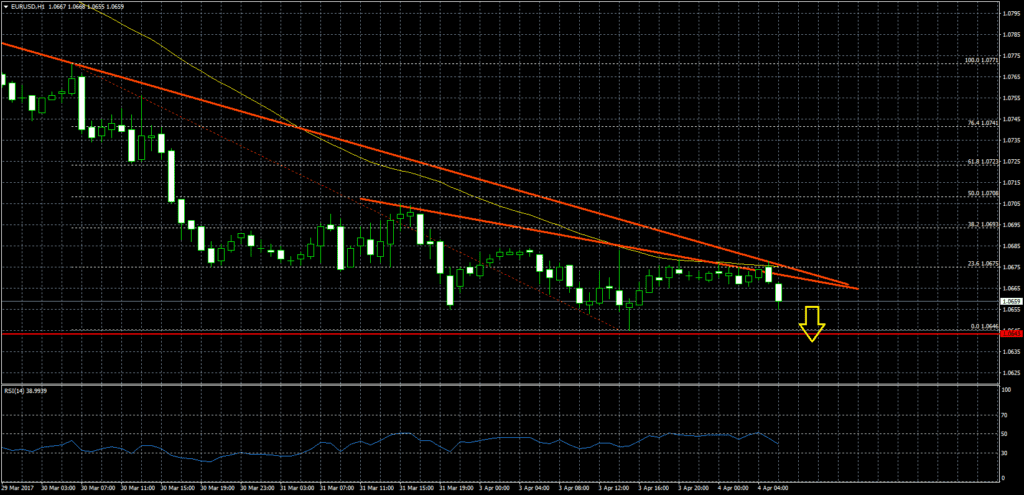

EURUSD Technical Analysis

The Euro faced a lot of selling pressure during the past few days, as it moved below the 1.0740, 1.0700 and 1.0680 support levels against the US Dollar. The EURUSD pair recently traded as low as 1.0646 from where it started a recovery.

However, the recovery found resistance near two bearish trend lines at 1.0675 on the hourly chart. The same area also coincides with the 21 hourly simple moving average at 1.0676.

So, there is a chance of the pair may resume the downside, and test the 1.0646 low. If the Euro sellers remain in action, there are chances of a decline towards 1.0620 or even 1.0600 in the near term.

Spanish Unemployment Change

Today in the Euro Zone, the Spanish Unemployment Change for March 2017 was released by the Spanish Government. The market was expecting the Spanish Unemployment Change to post -41.2K, compared with the last change of -9.4K in March 2017.

The outcome was above the forecast, as the change was -48.6K in March 2017. So, it looks like the total number of unemployed people declined in March by 48,559, compared to the previous month. The report added that with “respect to March 2016, unemployment has been reduced by 392,453 people. The annual reduction in unemployment maintained the high rate of recent months, standing at (-9.6%), the largest drop in a month in March of the entire historical series”.

Overall, the EURUSD might find it hard to recover, which is why a break below 1.0646 is possible in the short term.