Just a day away from Friday’s Nonfarm payrolls, took away the USD’s decisiveness into moving higher. The US Dollar index has currently stalled at 96.00 levels after rallying higher from 94.08 lows seen on the 18th August.

The Jobs figures are being viewed as a near term catalyst for further interest rate hikes, and if last week we were waiting for Yellen to tell us more on the next rate hike, this Friday we shall be waiting for the actual Nonfarm payrolls figures to give us such indication. Finally its always about the timing of the next rate hike.

USDJPY has managed to break above the 50 DMA las Tuesday and has protected that level at yesterday’s close as well. We currently see the currency pair hesitating going forward but novertheless the current price of 103.26 is safely above the 50 DMA at 102.62.

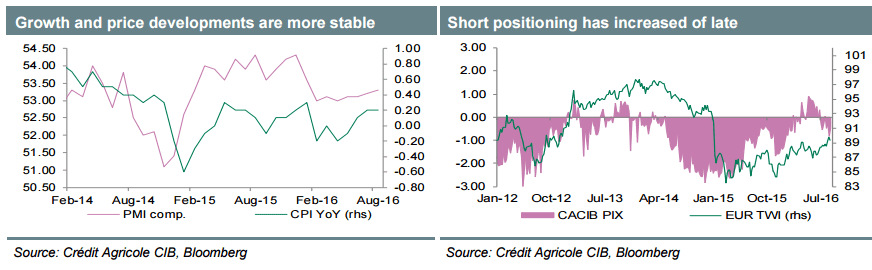

August Chinese Manufacturing PMIs were stronger than expected and making it into growth territory above the 50 figure. Despite the positive data however, sentiment was unable to make significant shifts into positive territory and overall major equity indices in Asia were mixed.

In Europe focus will now shift to EZ PMIs as once again traders will be sifting numbers to read the ECB’s next policy move.