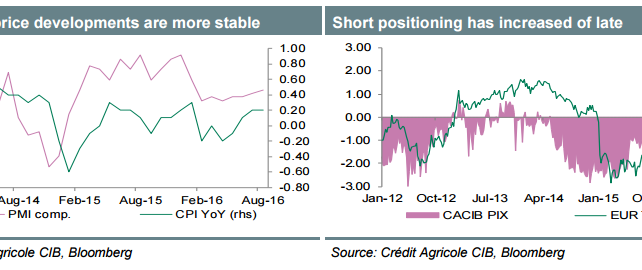

It cannot be excluded that there is the notion of ECB President Draghi considering a more dovish rhetoric, mainly on the back of medium-term inflation expectations as measured by 5Y inflation swaps remaining close to historic lows. However, while market based price indications may be misleading in the current environment and as actual data such as business activity and CPI has at least stabilised, there is hardly a case of increased downside risks to the central bank’s base case. It must be noted too that data has been resilient in the wake of the Brexit vote, which may actually be taken as a positive signal.

In conclusion we see limited scope of Draghi making a case of more policy action being considered anytime soon, especially as its adverse effects as related to the banking sector may just intensify.

As a result of the above outlined conditions position squaring related upside risks cannot be excluded, especially as EUR short positioning has risen of late.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article