The lower limits of RBA policy:

We think the RBA is likely to keep rates on hold when the board meets on 6 September.

This will be the last board meeting for Governor Glenn Stevens. The new Governor, Phillip Lowe, will take over on 18 September. The mildly pre-emptive rate cut last month took the official cash rate to a new record low of 1.50%. While inflation was in line with expectations, the Bank took the opportunity to bolster the growth outlook for 2017 when we expect more of a drag on growth from slower housing activity. It also gives the new Governor scope to resist pressure to cut rates again if 3Q inflation is weak.

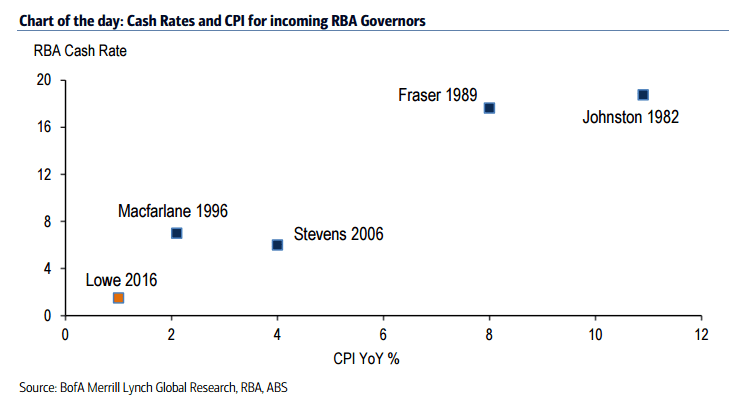

We expect another cut in 1Q17, but the scope for further easing would be constrained if broader financial conditions ease before then. The scope for Lowe to use traditional monetary policy to respond to unexpected economic weakness is far more limited than was the case for his predecessors at the start of their terms (chart), although the downward shift to the left reflects the global low inflation and rate environment. The net benefit of further easing is now much more marginal.

Implication for FX:

The search for positive yield has become a catch-all phrase to explain the resilience of high-yielding assets globally. Nowhere is this more evident than the AUD and NZD, where despite the reduction of policy rates since July, both currencies have remained supported.

Looking ahead, the key question is how long these "carry inflows" can persist, even as the yield advantage compresses further. There is clearly risk that structural price-inelastic flows like the grab for duration by pension funds and potential diversification by central banks may stay firm. But marginal carry demand should nonetheless weaken as yield spreads narrow and FX strengthens. As both the RBA and RBNZ extend their easing cycles, yield-motivated arguments for buying FX are likely to become less compelling over time, especially if global volatility rises, potentially due to the upcoming US election.

In terms of drivers more specific to AUD, we are watching iron ore and steel prices closely. The resilience in these commodity prices over the past three months has supported the AUD but may be set to reverse in the coming months, especially if China data slow. Our commodity team expects iron ore prices to weaken to $45/t avg in 4Q as seasonal weakness and a second-half lift in low cost supply bites. Deterioration in terms of trade would heighten the pressure on AUD from broader risk reduction ahead of the US election. Given the crowded long positions in the AUD, we think it will be especially vulnerable in a risk unwind scenario driven by external factors.

Copyright © 2016 BofAML, eFXnews™Original Article