AUD/USD 4H chart 7/19/2013 8:55AM ET

(click to enlarge)

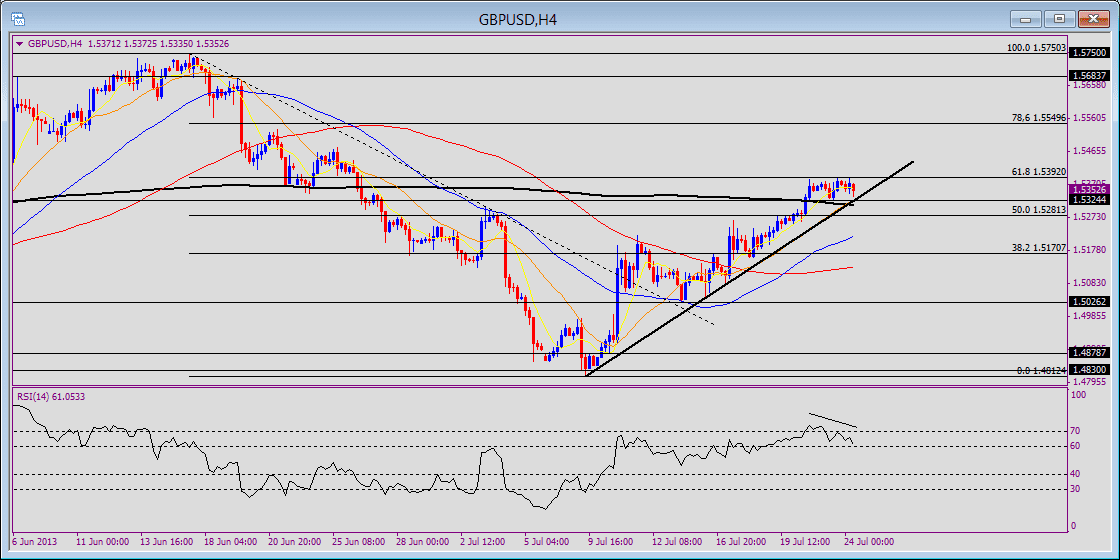

Bearish Momentum: AUD/USD has been sharply bearish since April 2013, when it fell from about 1.0590. The bearish mode remains as lower highs and lower lows are established, but the speed of the decline has been more gradual since June, and price action has been choppier. When you look at the 4H RSI, the reading has mostly held under 60 to show maintenance of bearish momentum, but it is being challenged again. The 200-4H SMA shows overall bearish mode as it hovers above price and other moving averages and has a downward slope. The smaller moving averages and price reflect a market in consolidation.

Price bottom scenario: Price action this week has been bullish from the 0.90 low. A break above 0.93 should break above the 200-SMA and the recent falling speedline. This should be an initial clue that the market is ready to put in a price bottom. However a break above 0.9345 would be needed to show that bulls are indeed taking over for the price bottom. If the 4H RSI pushes above 70, it will also help confirm that there is bullish momentum developing in this time-frame.

Otherwise, there is still a chance that the market is simply trading sideways. Above 0.9345, the AUD/USD will be exposed to the next resistance pivot around 0.9550 and then 0.9660.

Fan Yang CMT is a forex trader, analyst, educator and Chief Technical Strategist for FXTimes – provider of Forex News, Analysis, Education, Videos, Charts, and other trading resources