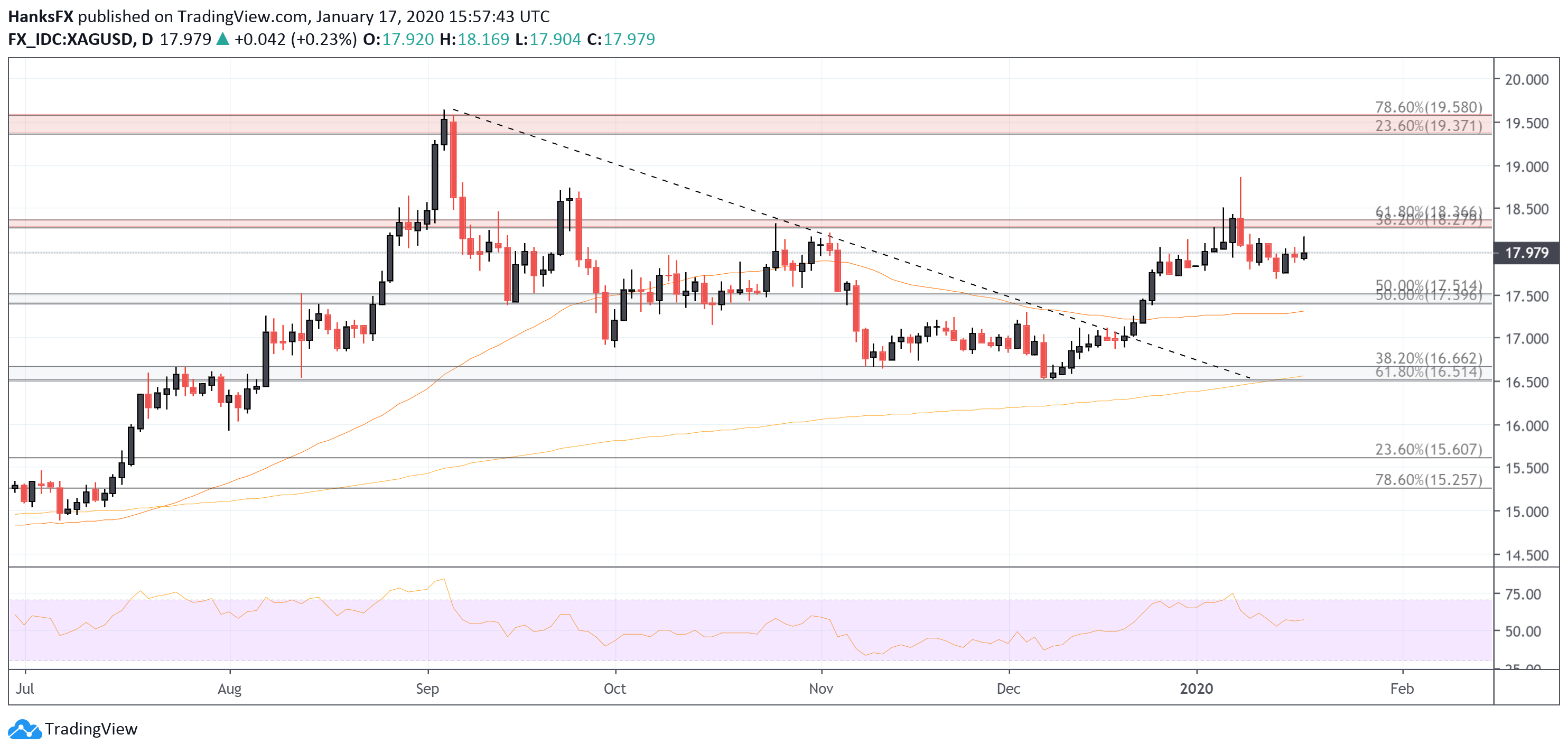

XAU/USD 1H chart 10/25/2013 10:10AM ET

(Click to enlarge)

Rising Channel: Gold has been rallying since 1251 in a rising channel seen in the 1H chart. It is stalling after hitting 1350 during the 10/24 session. It has failed to rally at the pace that would bring it to the channel resistance and instead drifted lower to break the rising channel support during the 10/25 session.

US data: As we get into the US session, the 8:30AM ET Durable Goods Orders release had a positive headline number for September: 3.7% vs. the 1.7% forecast and 0.2% previous readings. However the core reading was down: -0.1% vs. the 0.6% forecast, and the previous reading was revised down to -0.4% from -0.1%. The 9:55AM ET release of the last version of Umich consumer sentiment data for October came out at 73.2, missing forecast of 75.8. These mixed and possibly slightly US-negative data releases have stalled the 10/25 session USD-rally.

Bullish continuation scenario: When you look at the 1H chart, the 1H RSI reading has held above 40 and thus shows maintenance of bullish momentum. Price action still has the higher high, higher low pattern so the bullish outlook is still intact despite the violation of the channel support. If the market can push the 1H RSI back above 60, it is likely in bullish continuation with focus on the 1350 and then possibly the next resistance around 1374 (seen in the 4H chart).

Failure to breach above the 1350 handle today however suggests the market has turned from bullish to neutral, but yet to show bearish technicals other than barely breaking the rising support with only unimpressive price action.

XAU/USD 4H chart 10/25/2013 10:13AM ET

(Click to enlarge)

Fan Yang CMT is a forex trader, analyst, educator and Chief Technical Strategist for FXTimes – provider of Forex News, Analysis, Education, Videos, Charts, and other trading resources.