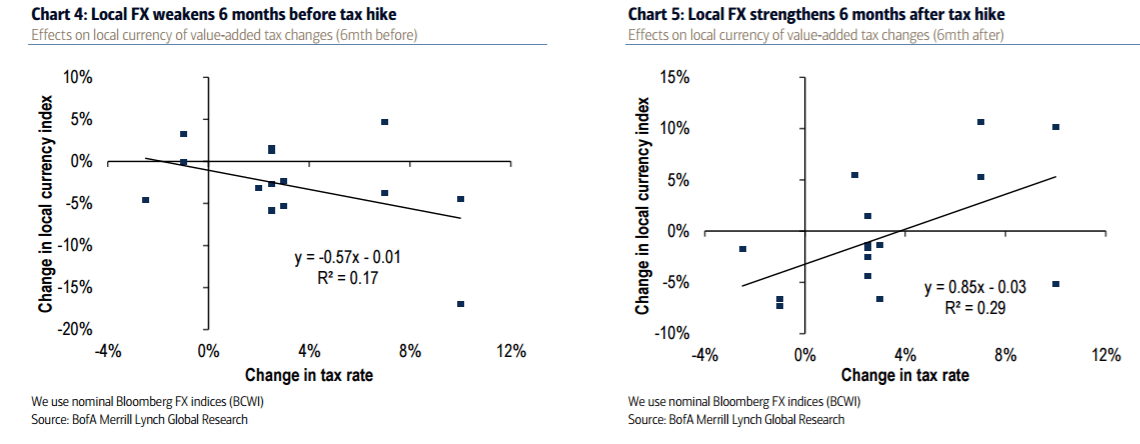

We analyzed the market reactions to VAT changes in five developed countries for a total of 17 tax events since 1973, to get a better grasp of what could be in store for USD in a hypothetical scenario where the US adopts a similar federal value-added tax.

There are three conclusions in our study: (1) inflation only picked up in the first year and then came back down, suggesting little impact on forward breakevens; (2) similarly, exante real rates saw a significant drop in the first year following the change in tax rate in most cases then settled back to previous levels; and (3) local currencies depreciated ahead of the tax hike and then appreciated in the months after.

FX: sell the rumor, buy the fact We consider the effects on local currencies six months before and after tax changes. We find some evidence that the local currency sold-off six months before the tax hike (Chart 4) and was bought back six months after (Chart 5). In our view, investors may have sold the local currency partly in anticipation of the tax change and later squared their position, though the data is a bit noisy. Given rising domestic inflation, local real exchange rate has depreciated.

While recent the USD sell off may partly be attributed to the anticipation of a possible tax adjustment, investors may want to position for USD gains in the scenario the rumor becomes the fact.

Copyright © 2017 BofAML, eFXnews™Original Article