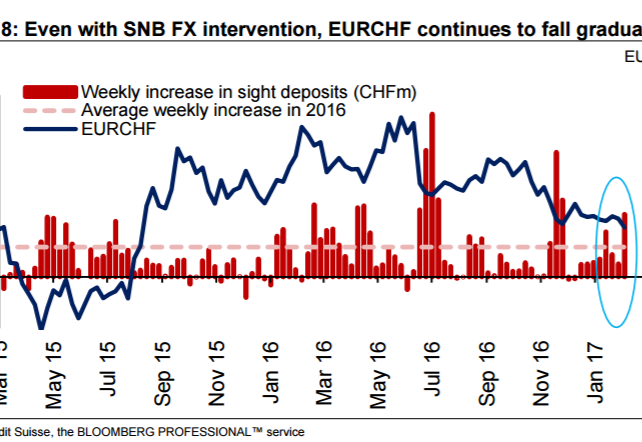

For the SNB, the fresh wave of concern about external headwinds complicates its juggling act even further. EURCHF has retained a clear downwards bias throughout January, despite the SNB intervening four times as much YTD as over December 2016 (Figure 8).

EURCHF also seems determined to fall even when the sheer extent of risks facing Europe only seem to be half-baked into market pricing, in our view. The fact that EURCHF implied vols are still near 2016 averages suggests deeper existential questions are not yet being asked. Nor do they seem to be priced into Swiss markets in other ways – such as through any meaningful increase in the probability of another rate cut by June 2017 (Figure 10). Should such complacency start to crumble, any central bank may struggle to singlehandedly bear the existential burdens facing an entire continent, especially if markets are more willing to question whether intervention is an acceptable strategy at a time when FX manipulation is a major concern for the new US administration, as discussed above.

Consequently, we lower our EURCHF 3 month forecast from 1.070 to 1.055. This intraday level in EURCHF was observed briefly after the UK’s surprise vote to leave last June – a day when the SNB unleashed its greatest intervention firepower since discontinuing the EURCHF floor. Nevertheless, we acknowledge that the path towards our 3 month target could, at times, feel swingy or stale with the SNB still actively in the picture. Some endurance may be necessary when the SNB still seems determined to avoid a disorderly manner of appreciation upon any given day or week.

Overall, the SNB may also believe it is inevitable that some gradual but temporary appreciation manifests in the lead up to one of the most important elections for Europe over the last decade. Yet if it sees eye to eye with our economists about the ultimate low likelihood of Le Pen winning, it may only see the dip in EURCHF as a passing and selfcorrecting phenomenon. The fact that CHF TWI is still well below 2016 levels (Figure 9) might add comfort to Governor Jordan’s attitude, at a time when scrutiny towards persistent FX intervention is also growing beyond the typical Swiss stakeholders

Indeed our economist’s high conviction that Le Pen still has very low chances of success also leads us to keep our 12 month EURCHF forecast unchanged at 1.06. Should the alternative scenario prevail, it may only be a question of ‘when’ rather than ‘if’ EURCHF reaches parity again.

FX Technical Strategy | Credit Suisse

———————————————-

EURCHF spotlight stays on critical support at 1.0623/04. Only below here would mark a more important top.

Above 1.0711 can see a near-term base for a recovery back to 1.0726. Beyond 1.0771 though is needed to mark a better low

EURCHF below 1.0711 can keep the immediate risk lower for the June-16 spike low and 61.8% retracement of the April-15/February-16 rally at 1.0623/04. Below here though is needed to mark a more important top, for 1.0445/40.

Copyright © 2017 Credit Suisse, eFXnews™Original Article