Key Points

- The Aussie dollar traded with a lot of strength this week against the Kiwi Dollar and traded above the 1.0530 resistance.

- The AUDNZD pair broke a monster resistance trend line on the 4-hours chart at 1.0520 to open the doors for more gains.

- Today in Australia, the Home Loans report was released by the Australian Bureau of Statistics.

- The result was below the forecast, as there was an increase of 0.4% in Dec 2016, less than the forecast of 1%.

AUDNZD Technical Analysis

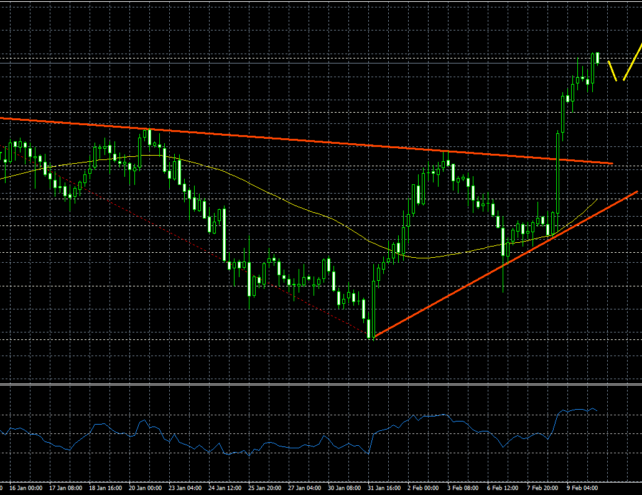

The Aussie dollar gained a lot of pace against the Kiwi dollar this week and trade above the 21 hourly simple moving and the 1.0630 resistance. The upside move was so strong that the AUDNZD pair broke a monster resistance trend line on the 4-hours chart at 1.0520.

The pair also broke the 61.8% Fib retracement level of the last decline from the 1.0572 high to 1.0327 low. It has also surpassed the 1.0572 high, and currently trading near the 1.236 extension of the last decline from the 1.0572 high to 1.0327 low.

There are chances of AUDNZD breaking the 1.0630 level and trading further higher, may be towards 1.0650 and 1.0680.

Australian Home Loans

Today during the Asian session, the Australian Home Loans, which presents the number of home loan was released by the Australian Bureau of Statistics. The market was expecting a rise of 1% in Dec 2016, compared with the previous month.

However, the result was below the forecast, as there was an increase of 0.4% in Dec 2016. The report added that the “trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.8%. Investment housing commitments rose 1.7%, and owner occupied housing commitments rose 0.2%”.

Overall, the Aussie dollar may correct a few pips lower from the current levels, but the AUDNZD pair could trade towards 1.0650-1.0680 in the near term.