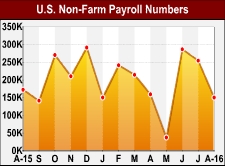

Employment in the U.S. increased by less than anticipated in the month of August, according to a report released by the Labor Department on Friday.

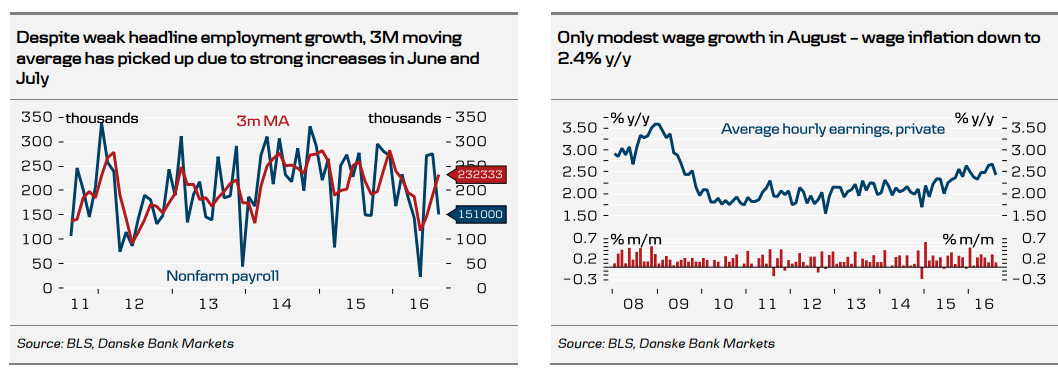

The Labor Department said non-farm payroll employment rose by 151,000 jobs in August after surging up by an upwardly revised 275,000 jobs in July.

Economists had expected employment to climb by about 175,000 jobs compared to the jump of 255,000 jobs originally reported for the previous month.

The weaker than expected job growth came as an increase of 150,000 jobs in the service-providing sector was partly offset by the loss of 24,000 jobs in the goods-producing sector.

Private sector employment subsequently rose by a disappointing 126,000 jobs, although the government also added another 25,000 jobs.

The report also said the unemployment rate held at 4.9 percent in August, unchanged from the previous month. The unemployment rate had been expected to edge down to 4.8 percent.

The unemployment rate held steady as the household survey measure of employment increased by 97,000 jobs, but the number of people in the labor force also climbed by 176,000.

The Labor Department also said average hourly employee earnings edged up by $0.03 or 0.1 percent to $25.73 in August.

Average hourly employee earnings in August were up by 2.4 percent compared to the same month a year ago, reflecting a slowdown versus the 2.7 percent increase in July.

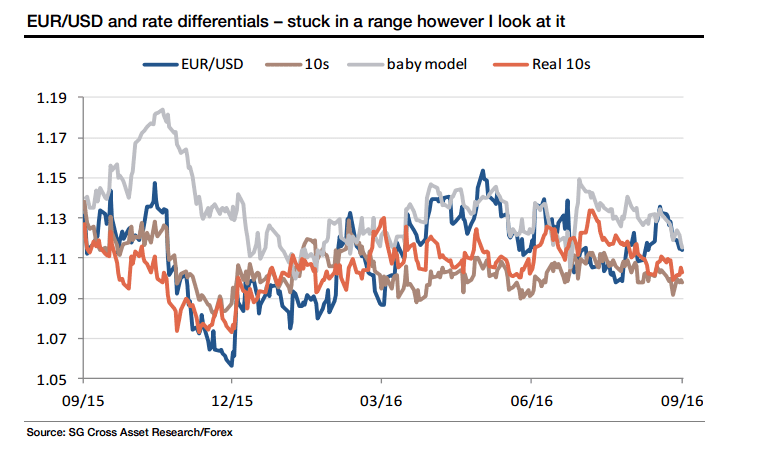

While the data is somewhat disappointing, analysts have suggested that the report will lead the Federal Reserve to refrain from raising interest rates at its next meeting later this month.

"The report doesn't support the case for a September rate hike," said ING Senior Economist James Knightley. "After all inflation pressures are very benign and the U.S. election has the potential to weigh on sentiment and activity a touch."

He added, "On the other hand, an increasing number of Fed speakers have suggested that they are comfortable to hike rates despite relatively subdued employment growth meaning a December move should not be ruled out."

Last week, Fed Chair Janet Yellen said she believes the case for raising rates has strengthened in recent months but stressed that policy decisions always depend on the degree to which incoming data continues to confirm the central bank's outlook.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Forex News