These longer-term concerns threaten the EM and yield-friendly trends that dominated over the summer and, at the same time, threaten the mildly dollar-friendly interest rate backdrop within G10FX. But they may not be relevant in the next few months, let alone the next few weeks. For now, what we have, first and foremost, is a very range-bound EUR/USD. Since this accounts for 23% of OTC FX turnover, according to today’s brand-new triennial survey, that’s a problem

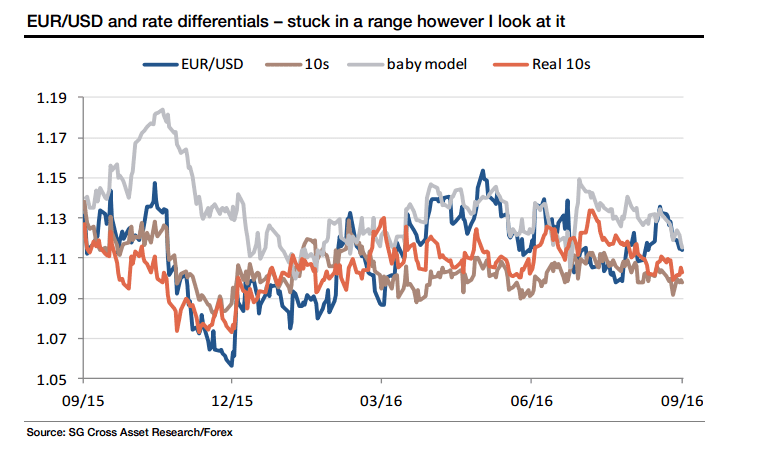

The ECB remains under pressure to keep rates anchored. Some slight softening in survey data and a small dip in CPI inflation will keep the pressure on, which really means that the central bank’s bond-buying programme is likely to be extended. But the 10year yield differential between Germany and the US has been stuck in a 20bp range for the last 6 months, the 2yr yield spread’s only 5bp wider and the 10-year real yield differential range is only marginally wider than that. Last year’s 1.05-1.16 range in EUR/USD is likely to hold as long as there are no policy surprises. That said, two points are worth nothing. The first is that my old ‘baby model’ of EUR/USD, based on volatility and peripheral yield spreads, as well as interest rate differentials, is beginning to provide useful signals for EUR/USD again. That is interesting because the euro is now vulnerable (to some degree) to idiosyncratic political risks in Europe. Or I may be grasping at straws.

The second point worth noting is that the broad yield differential relationship, looked at over the longer term, is holding, even if day-to-day correlations are down sharply. If we get a shift in relative monetary policy, the EUR/USD rate will react. Or, to put it simply, the next 50bp move in 10-year Treasury yields will determine which end of the EUR/USD range is tested and, from here, I’d still fancy a move to higher yields rather than lower ones.

The second most-traded FX pair, USD/JPY, has the benefit of being more interesting. Its best level of the last year, close to 124, came just after 10-year Treasury yields hit their peak at 2.34, and the lowest closing level was on the day when 10year Note yield traded below 1.35%. If Treasury yields go higher from here on Fed hawkishness and if the global investment backdrop remains risk-friendly, USD/JPY really ought to move higher.

Could we see the BOJ disappoint again this month? Could we see USD/JPY spike sharply lower if it were to break 100? The answer to both is a resounding ‘Yes’. But if real yields have peaked in Japan, and nominal and real yields have troughed for now in the US, then any yen strength from here is a chance to sell.

Copyright © 2016 Societe Generale, eFXnews™Original Article