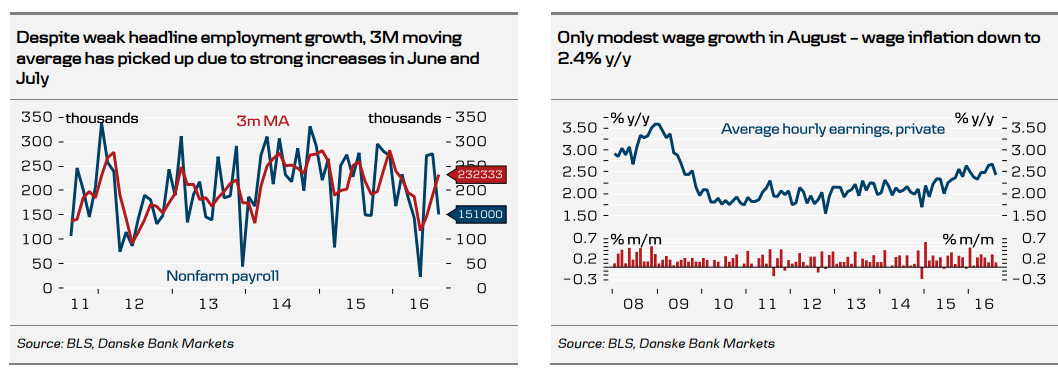

Overall, the August jobs report was not strong enough for the Fed to hike at the next meeting in September, especially not after the very weak ISM report released yesterday, with the index falling below 50, indicating a contraction in the US manufacturing sector.

Although our view is that the Fed will stay on hold until H1 17, we cannot rule out a hike later this year, most likely in December following the presidential election, if we see some recovery in the US activity data and continued decent jobs growth in coming months.

One main reason we moved our expectation for the next Fed hike to next year was due to Brexit but, so far, the economic impact of Brexit has been very limited in the rest of Europe and the US. Still, as we have argued for some time, most voting FOMC members have a dovish-to-neutral stance on monetary policy and would rather postpone the second hike than hike prematurely, although some FOMC members (especially non-voters) appear to be eager to get going with the hiking cycle. The Fed can afford to stay patient, as GDP growth has been just around 1% for three consecutive quarters, PCE core inflation is still below 2%, inflation expectations (both survey based and market based) have fallen and wage inflation is still subdued.

Copyright © 2016 Danske, eFXnews™Original Article