The dollar held on to its gains early on Wednesday, as a rebound in Treasury yields helped the greenback bounce back from recent lows hit against the yen and euro amid concerns about U.S. President Donald Trump's protectionist stance.

USD/JPY rose just shy of 114 to 113.98. It had jumped about 1 percent the previous day, bouncing from 112.520, its lowest since late November.

EUR/USD dipped to 1.0710. The single currency had slipped about 0.3 percent overnight, sliding from a near seven-week high of 1.0775.

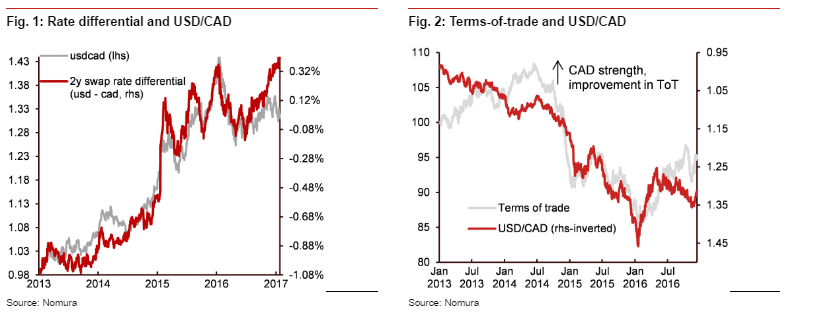

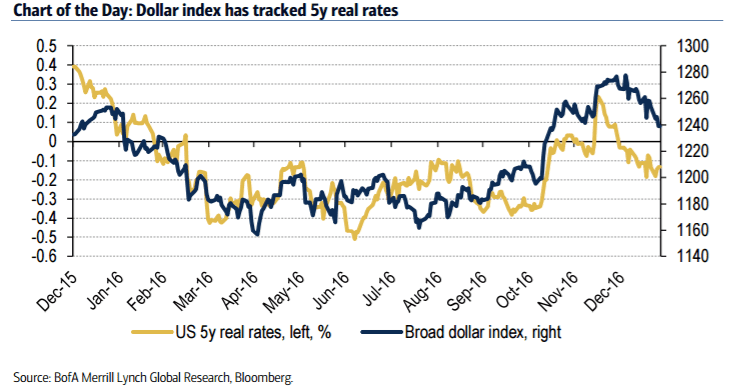

The dollar had soared to 14-year highs of 103.82 against a basket of major currencies in the eight weeks following Trump's surprise election victory in November.

Forex Investors bet his promised infrastructure spending and tax cuts would boost economic growth and inflation, leading the Federal Reserve to follow through with a series of rate hikes.

However, the dollar index skid tdedo 99.922 on Tuesday, as Trump's inaugural speech sparked concerns about his stance on trade protectionism. The Dollar index last stood at 100.270.

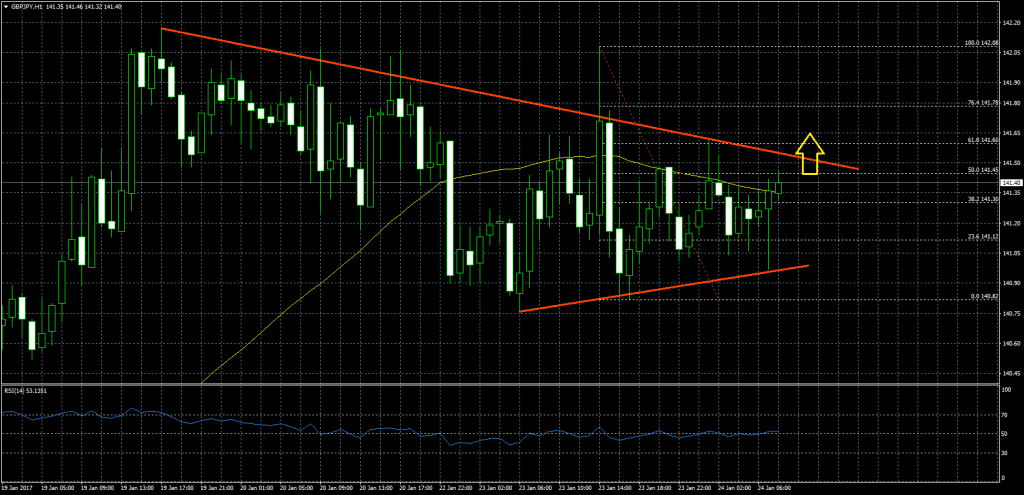

Meanwhile, the pound was up 0.1 percent to 1.2540. GBP/USD had fallen to as low as 1.2420 overnight before bouncing back after the British Supreme Court ruled that the government must go through parliament, but not the U.K.'s regional assemblies, to trigger talks on leaving the European Union.

The Aussie dollar slipped to 0.7514 after getting as high as 0.7598. But the dollar's broader overnight strength kept the Aussie away from a 10-week high of 0.7609 scaled the previous day.

U.S. Treasury yields jumped back on Tuesday as investors snapped up equities on improved outlook on corporate profits, trimming their safe-haven demand for bonds spurred by U.S. President Donald Trump's protectionist trade stance.