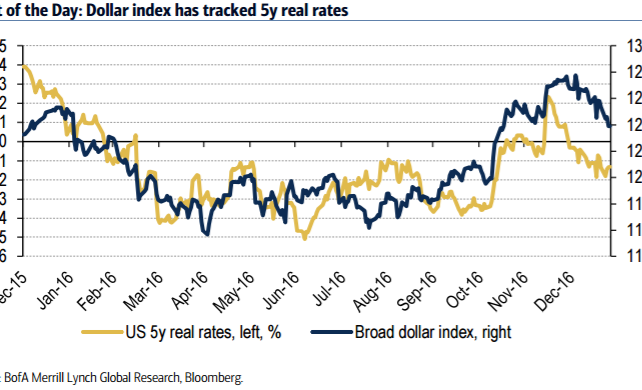

At the surface, the "Trump trade" unwind appears remarkably partial. While the higher dollar view has been challenged at the start of 2017, reflation trades including cyclical stocks and commodities have held up relatively well. The answer, as we have often argued, lies in the relative paths of US inflation breakevens and real rates: these moved higher in tandem post-election, but have since diverged. As is typically the case, stocks have tracked breakevens, while the US dollar has tracked real rates.

Long USDJPY offers best risk-reward under various scenarios*

Given our core view that US real rates will move higher, there are two scenarios that matter: (1) simultaneously higher real rates and breakevens – consistent with the post-election market optimism and (2) higher real rates and lower breakevens – potentially due to a risk-off shock to global markets.

Drilling deeper into this relationship, we look at average returns under two scenarios since 2010 (1) weeks when US 5y real rates and breakevens rise and (2) weeks when US 5y real rates rise and 5y breakevens fall. For completeness we show the average returns during a falling real rate environment. We highlight the followingfrom this analysis.

-The year-to-date experience has been one of lower real rates and higher breakevens: Chart 7 shows this is a broadly negative backdrop for the US dollar and positive for stocks and commodities, consistent with the observed price action. A reversal in these broad trends would most likely be associated with lower breakevens, which seems unlikely in the near term.

-If US real rates do rise, buying USD/JPY presents the best risk-reward opportunity if we are agnostic on breakevens. Chart 6 shows the JPY typically depreciates irrespective of the direction of breakevens (as does the EUR) and Chart 5 shows it is more generally closely correlated with 5y real rate differentials.We recommended buying USD/JPY earlier this week targeting 120.*

*This trade is recorded in eFXplus Orders.

Copyright © 2017 BofAML, eFXnews™Original Article