USD/CAD has been relatively volatile in recent weeks, oscillating between 1.30 and 1.36.

Many factors have been affecting CAD lately, both on the upside and the downside: the election of Donald Trump and the impact of his economic policies, the OPEC production cut deal, USD weakness, the recovery in global output as evidenced by the PMIs, an increase in industrial commodity prices, improved Canadian economic data and the Bank of Canada’s reminder that rate cuts are ‘still on the table’ given the large potential negative shocks to the economy.

Valuation:

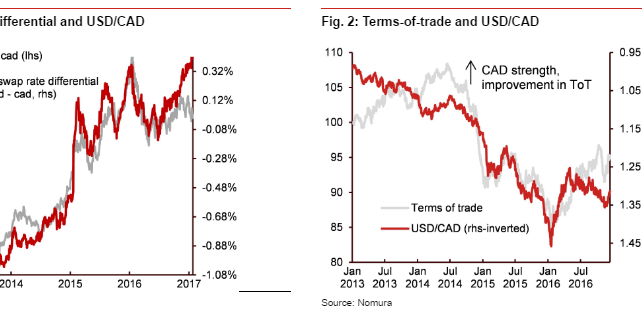

With the rate differential and terms-of-trade pushing USD/CAD in opposite directions, it is very likely that the fair value for the cross is somewhere in between. Using our valuation model, based on a co-integrated relationship between commodity prices and USD/CAD, we find that fair value for USD/CAD is around 1.29, given current commodity prices and the current rate differential.

Positioning:

With net positioning still marginally net short as of last Tuesday’s data , room for more CAD strength because of position unwinding remains supportive of our call, at least in the short term.

Taking into account all these factors, we remain comfortable with our forecast that USD/CAD is likely to end Q1 at around 1.28.

Copyright © 2017 Nomura, eFXnews™Original Article