Yesterday Chinese manufacturing PMI eased marginally lower breaching 50 levels and going into contraction; in the US ISM Manufacturing for July came out at 52.6 marginally lower than the previous 53.2 but still in growth territory and showing some stabilization.

Investor sentiment, measured by equity performance, continued to be largely negative even yesterday at close following oil prices lower. The negativity continued even in this morning’s Asian session with much of the major indices trailing lower.

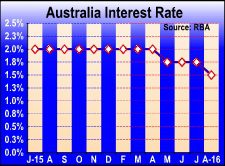

Early this morning the Reserve Bank Of Australia cut interest rates to record lows of 1.5% from a previous 1.75% mostly in line with expectations. The RBA highlighted historically low inflation and excess capacity in the labour market, and while also acknoweldging that business conditions remained positive it believed a further cut could boost economic growth and labour market conditions and counter-act a large decline in business investment.

Aussie has dropped to lows of 0.7480 (opened at 0.7534) as it reacted to the rate cut and has recovered 0.75 levels (although it remains in negative territory for the day) as we approach the european session.

The US dollar index is looking south again this morning, after a small break in the 5-day losing streak seen last week. The USD is currently trading at 3-week lows. Some recent weak GDP data did not help the USD and yesterday’s ISM data was not good enough to change the mood apparently.