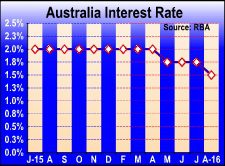

Australia's central bank lowered its key interest rate for the first time in three months, with the rate now at a fresh record low, as the bank seeks to reinvigorate growth amid weak inflation and subdued wage growth.

The board of the Reserve Bank of Australia governed by Glenn Stevens reduced the cash rate to 1.50 percent from 1.75 percent.

The outcome of the meeting came in line with expectations. The new rate would be effective from August 3.

The bank last reduced its rate by 25 basis points in May, which was the first reduction in a year.

The Board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting.

Paul Dales, chief Australia and NZ economist at Capital Economics, expects the rate to remain at 1.5 percent for some months before stubbornly low inflation prompts the RBA to reduce them to 1 percent next year.

Inflation was just 1 percent in the June quarter, well below the RBA's target band of 2-3 percent.

Given very subdued growth in labor costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time, the bank said.

Further,the RBA noted that labor market indicators continue to be somewhat mixed, but are consistent with a modest pace of expansion in employment in the near term.

Low interest rates supported domestic demand and the lower exchange rate since 2013 has helped the traded sector. Although these factors assisted the economy to make the necessary economic adjustments, an appreciating exchange rate could complicate this, the bank noted.

Policymakers said the likelihood of lower interest rates exacerbating risks in the housing market has diminished.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News