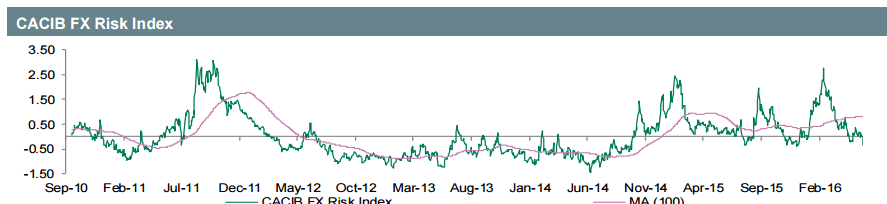

At -0.18 (vs -0.33 on 26 May) our Risk Index has moved into less risk seeking territory. The latest development was mainly due to rising cross market volatility as, for instance, driven by this week’s development in the JPY. Elsewhere, renewed uncertainty when it comes to the 23 June EU referendum and more muted data out of China were key. However, current levels remain indicative of broadly stable sentiment.

Looking ahead, it should be about investors’ Fed monetary policy and global growth expectations to drive risk appetite. In that respect this week’s US labour data may be key. Even if data were to surprise positively, it appears unlikely that short-term Fed rate expectations have much potential to rise.

In fact, external risk events such as the EU referendum support the notion of the Fed refraining from further tightening ahead of July. In addition, it must be noted that any further increase in longer-term rate expectations from current levels would require a brightener growth outlook.

In an environment where rising growth expectations compensate for a tighter monetary policy stance’s dampening impact on risk, overall sentiment is likely to remain stable. Even if Fed rate expectations remain capped, pairs such as USD/CHF may benefit from such conditions. The pair has been increasingly driven by risk sentiment of late.

Accordingly it cannot be excluded that USD/CHF will remain on track to reach levels above parity anew in the weeks to come, unless risk aversion makes a comeback.

For latest trades & forecasts from major banks, sign-up to eFXplus

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article