US Dollar marked a fresh 8-week high yesterday, as the greenback celebrated some better than expected US New Home Sales Data and US Dollar index (DXY) reached daily highs of 95.66. The home sales data, which was relative to April, came out much stronger than expected at 16.6% as opposed to an expected 2% and a previous -1.5%.

Stronger US data bodes well for US economic growth and in turn implies a greater chance of US rate hikes to soak up the excess liquidity in the system.

Overall sentiment was good as well, as the major US equity indices closed in the positive on Tuesday. Risk-on mode was supported by the solid US Home Sales data but also on European markets celebrating the results of a UK poll showing less support for the leave-Europe cause. This morning even Asian markets are reflecting this positivity.

In the currency markets even the USDJPY reflected the reduced risk aversion as the USD took the lead on the safe haven Yen, the USDJPY is currently trading at 110.03 at the time of writing.

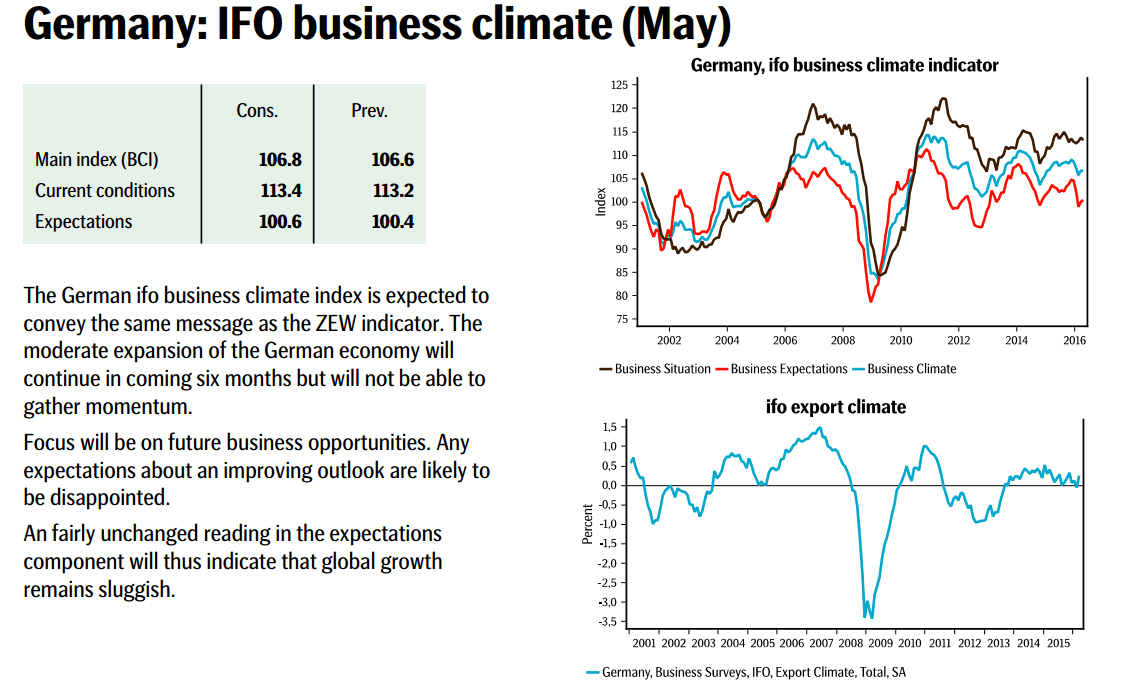

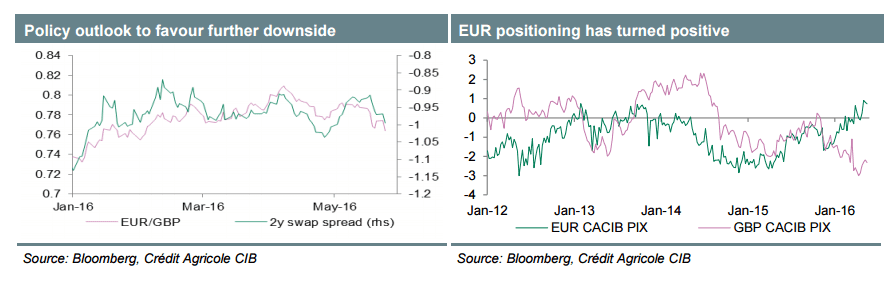

In general we had no surprises from the final reading of the German Q1 GDP results and the broader EZ Zew Survey eased lower. The euro has been weaker against the US Dollar since the begining of May.

The data with greatest impact today will eb the BoC rate decision, consensus figures are pointing towards no rate change at#nd to stay at the current 0.5%.