For most of the past few weeks the single currency has been rangebound, mainly on the back of stable central-bank rate expectations. Although the ECB has explained repeatedly that more can be done, it has been indicated by several central-bank members that more time may be needed in order to evaluate the latest policy steps’ impact on the economy. It must be noted too that Eurozone inflation expectations have been more stable, which may suggest that the current policy mix may be appropriate to bring inflation back to target.

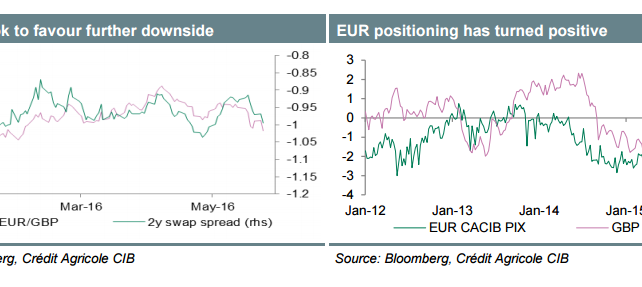

Even if ECB President Draghi refrains from sounding more dovish on monetary policy as early as next week, such prospects seem to be largely in the price already. This is especially true when considering that speculative EUR long positioning has increased to multi-year highs. From that angle, rising monetary-policy expectations or an improving capital flow situation may be needed in order to trigger more sustainable currency upside. In both cases a trend of sustainably improving conditions may be needed, which seems unlikely in the short to medium term.

As a result, the best case for rate expectations appears to be remaining stable for longer. This stands in contrast to the BoE: Brexit-related uncertainty has been keeping business activity and investors’ BoE rate expectations capped. Hence, no Brexit will result in a rebound as already indicated by several BoE members.

According to the latest polls, the probability of the UK avoiding a Brexit has been rising. Should such a trend continue, it may not come as a big surprise if investors’ focus increasingly shifts back to growth and price conditions as a driver of rate expectations and the currency.

It must be noted too that key UK data such as retail sales and employment has been holding up better than feared, while mediumterm inflation expectations remain well supported close to 3%.

All of the above – and keeping in mind that our base case remains that a Brexit will be avoided – should lead to policy differentials diverging further to the detriment of EUR/GBP in the weeks and months to come.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article