USD/JPY – NEUTRAL BIAS – (102.50-104.50)

At the beginning of H2 FY16, foreign bond selling by Japanese investors is lower than at this time last year. Investors want to hold their foreign assets and not realize their gains at this stage. Many of them are cautiously watching to see the reality of QQE with yield curve control under the BoJ.

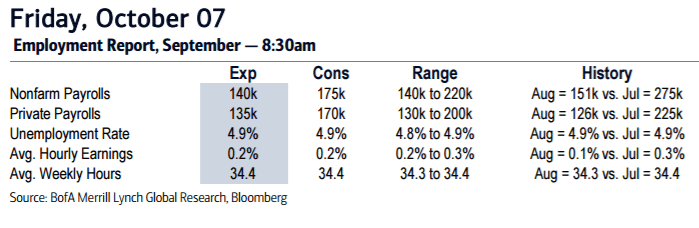

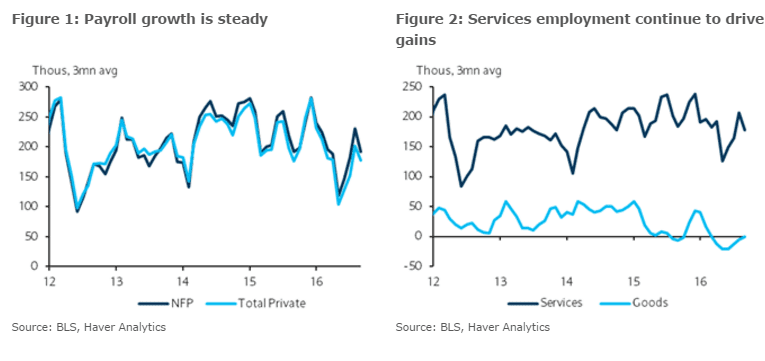

In the near term, the September nonfarm payroll report must be a trigger for the US dollar. Better non-farm payroll results might not support US dollar appreciation amid current global financial market uncertainty.

The recent JPY depreciation might be driven by large-scale foreign direct investments and JPY position unwinding. Those factors may continue to promote JPY selling, but they are unlikely to support an aggressive USD/JPY rise at this stage.

Copyright © 2016 BTMU, eFXnews™Original Article