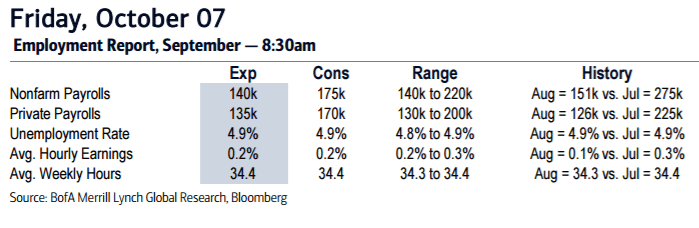

BofA Merrill: We look for another week employment report in September with only 140,000 in job growth and potential upward revisions to August. As we have previously written, August and September historically surprise on the downside and then are revised higher. We also think there is a risk that government hiring slows after relatively strong growth over the past few months. As such, we look for private payroll growth of 135,000. We look for the unemployment rate to remain unchanged at 4.9% in September. A risk to the unemployment rate is a potential further expansion in the labor force which could boost the unemployment rate. We look for average hourly earnings to grow by a trendlike 0.2% mom, bumping the year-over-year rate back up to 2.6% from 2.4% in August. However, this remains a fairly range-bound pace of wage growth.

Barclays: We look for nonfarm payrolls to rise 200k. We expect 185k of these gains to come from the private sector, with government payrolls adding the remaining 15k. We expect the unemployment rate to decline one-tenth, to 4.8%, average hourly earnings to rise 0.2% m/m and 2.6% y/y, and the average workweek to tick up 0.1, to 34.4 hours

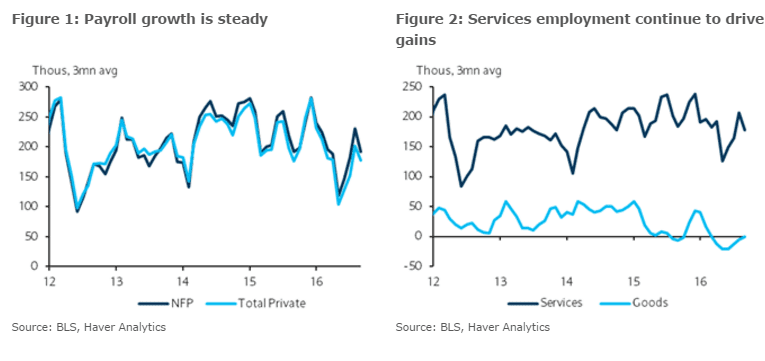

BNPP: The September employment report is expected to come in firm with a healthy revision to the first estimate for August payrolls. The current thrust of payrolls has been impressive with an average 175,000 jobs added over the past six months. For September, we expect about 160,000 jobs to have been added in the month – a notch above the FOMC’s estimates for the rate of payrolls that keeps the unemployment rate constant.

Credit Agricole: Our estimate is for a 175K rise for September nonfarm payrolls and a decline in the unemployment rate to 4.8%.Payroll forecasts center on a range of +150K to +200k with the median at 175K. The economic release calendar leaves us with less employment-related data than normal upon which to base our forecast. We look for the average workweek to edge up to 34.4 hours. The unemployment rate may decline to 4.8% in September, which is the Fed’s estimate of full employment.

SEB: We expect a 160k advance in September payrolls. and a steady 4.9% employment rate.

*Times reported are local NY time.

Copyright © 2016 eFXplus™Original Article