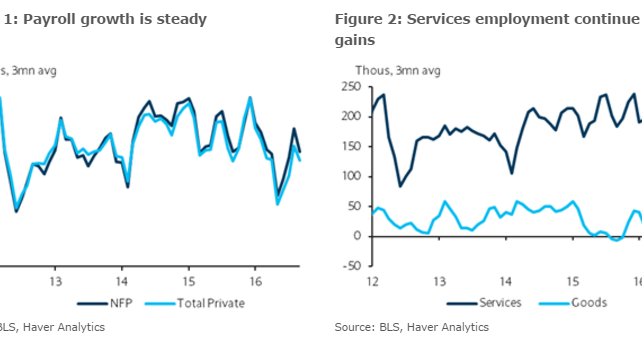

Nonfarm payrolls rose by 156k in September, well below our and consensus forecasts, while payroll growth for August was revised modestly higher to 167k from 151k as previously reported. Employment in September was led by the services sector, where payrolls expanded by 157k, while employment in manufacturing continued to decline (-13k). Although we did not get our expected rebound in services sector employment in September, the recent strength in survey-based measures, especially the employment subcomponent of the ISM nonmanufacturing index in September, which surged to 57.7, indicates much more strength to come. Most of the miss in headline relative to our expectation came from a slowing in leisure and hospitality services employment as well as a slowing in education and health. Government employment, where we had expected a 15k rise, also disappointed falling 11k in September.

Elsewhere in the report, the unemployment rate moved higher to 5.0% amid a tick up in the participation rate of 62.9% . Average hourly earnings increased 0.2% m/m bringing the y/y change to 2.6% . The household survey showed considerably more strength in employment, posting a gain of 354k in September. In general, we discount job gains in the household survey and take slightly more signal from the establishment survey.

It is not clear to us that the labor market momentum evident in this report is fully consistent with a December rate hike, given Chair Yellen’s views on the recent trend in participation and the recent slowing trend in headline employment growth.

Nonetheless, most members will likely take comfort from the underlying details of the report along with the relative strength in wage growth. The FOMC will receive two more reports before the December meeting.

Copyright © 2016 Barclays Capital, eFXnews™Original Article