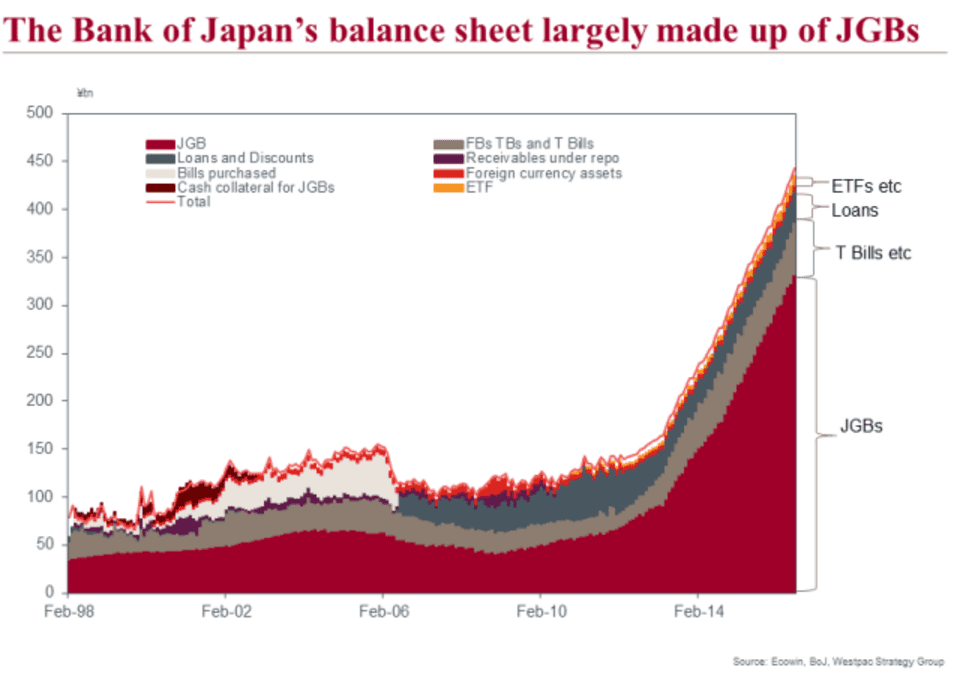

With each wave of quantitative easing (QE) unleashed by central banks around the world, the surge in liquidity chasing yield and depressing volatility gets larger and larger. However, in the last few weeks, markets have started to question whether we may be approaching the limits of QE.

We have been talking to these risks for many weeks, the risks that markets swing from pricing QE Infinity to QE Exhaustion.While it is surprising how quickly it has happened, there are real risks that the yield sell-off can continue, depending on what the Bank of Japan (BoJ) announces next week.

We discuss our thoughts on how and why we are about to hit a limit to QE in Japan; that the BoJ will likely need to become more inventive to extend beyond this limit; that the BoJ has been fighting not just low growth and deflation but also a deep rooted risk aversion within balance sheets in Japan; the best way to deal with this is with more NIRP and that financial risk sentiment could deteriorate further on such an outcome.

FX impact:

To be sure, a “QE exhaustion” signal from the BoJ is of course a vastly different proposition to an active tapering in purchases or an outright decline in the size of the BoJ’s balance sheet. The BoJ’s balance sheet is set to remain bloated for an indefinite period. That said, any hints from the BoJ that it has reached the limits of QE in its current form would nevertheless likely lead to significant dislocation in global markets – a significant decline in risk appetite and a sharp decline in USD/JPY in short order.

Historical analogues point to a hefty fall in JGBs – the six largest significant declines in JGBs back to 1993 saw 10yr JGB yields rise by an average 103bp; albeit with a wide variation: +50bp to +170bp. Retail investor outflow likely slows to a trickle if not an outright reversal and net fixed income flows turn back toward more appetising JGB yields.

USD/JPY would likely break below 100 in fairly short order, en route to the 90-95 zone. Such an outcome would clearly continue weighing on commodity currencies, and our preferred valuation process for short term fluctuations suggests theA$ for instance could continue to fall towards 0.72 before we view it as cheap.

Copyright © 2016 Westpac, eFXnews™Original Article