USD bulls were left feeling somewhat deflated following this week's Fed policy decision as the FOMC delivered a hike but with little change to the projections and a cautious tone from Chair Yellen, notes Bank of America Merrill Lynch Research.

As such, BofAML argues that with the March hike now duly delivered, and market pricing broadly in line with the dots, the trigger fora meaningfully higher USD will have to come from the fiscal side.

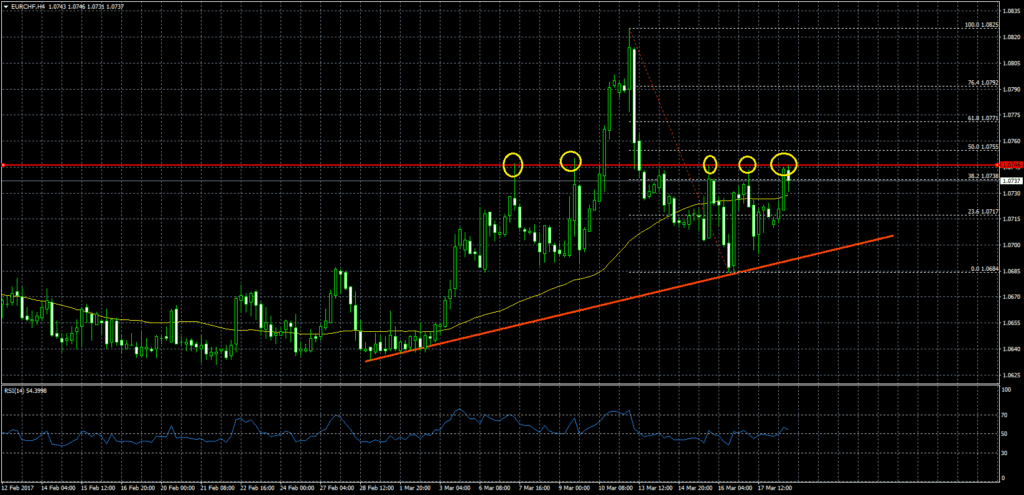

Turning to Europe, BofAML thinks that political risks remain a key near-term downside risk for EUR, but absent a Le Pen victory in the coming French elections, medium-term EUR risks are tilted to the upside.

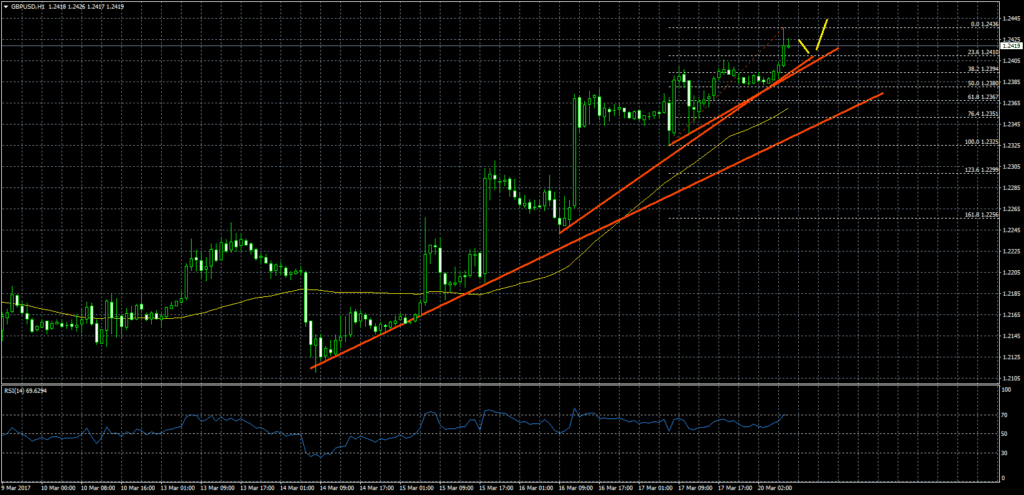

Finally, on the GBP front, BofAML believes that the initial stages of the Brexit negotiations will dominate GBP sentiment in the coming weeks on Article 50 triggering which should see sterling moves back towards 1.20.

Source: Bank of America Merrill Lynch Rates and Currencies ResearchOriginal Article