US Dollar Traders Focus More on Volatility, Less on Fed

Fundamentally, the dollar has been left adrift. High profile event risk has thinned out and the market’s obsession with rate forecasting has tempered. Yet, we might just find something far more provocative and capable to take up the currency’s reins: risk trends.

Big Warning Sign for Japanese Yen – Time to Abandon Positions?

Professionals scrambled for explanations on why the USDJPY posted a sharp 50-point tumble in the typically-quiet period after London markets closed. And indeed some initially pointed to a so-called “fat finger trade”—where a trader accidentally places an especially-large order that sends markets reeling. Yet the truth was far simpler: there was indeed a spike in USDJPY selling (Yen buying), but nothing about it seemed accidental.

AUD at Risk as Rate Hike Bets Squashed Alongside Geopolitical Turmoil

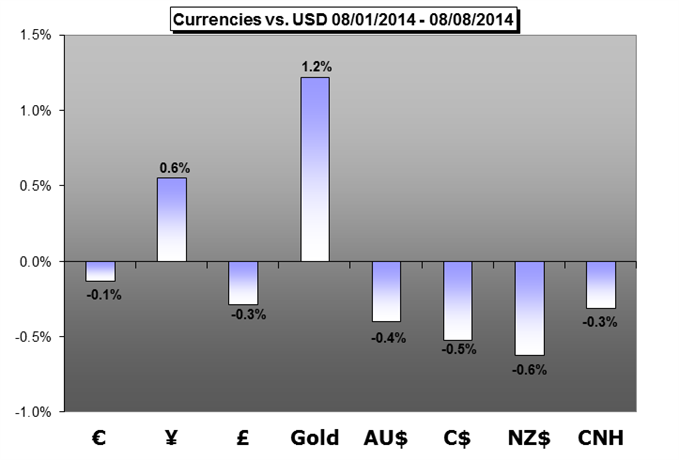

The Australian Dollar extended its recent declines over the past week on the back of broad-based risk aversion and disappointing domestic data. Heightened geopolitical turmoil sapped demand for the high-yielding currency as traders flocked to the perceived safety of the Yen and US Dollar. Looking ahead, if we see tensions surrounding the Middle East or Ukraine escalate, the Aussie could face further weakness in the short-term.

Gold at Resistance as USD Stalls, Stocks Roll Over- $1321 Key

With mounting concerns over new US military involvement in Iraq and the ongoing turmoil seen in Gaza and Ukraine, the onset of more classic risk aversion flows have been identified with gold likely biggest beneficiary. However, with the precious metal closing the week just below key near-term resistance, the focus shifts to the initial August range.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx