US Dollar index (DXY) fails to hold 100 levels and is now at 99.70. The USD swiftly sold off after after US President Trump and his economic adviser took a hit at how the major US trading Partners namely Germany, Japan and China pursued currency devaluation at the US’s expense.

These comments were taken to imply that the current US administration would seemingly prefer a weaker USD. EURUSD taking advantage of the weaker USD peaked to 7 ½ week highs as it hit 1.0812, this level also coincided with the 100DMA.

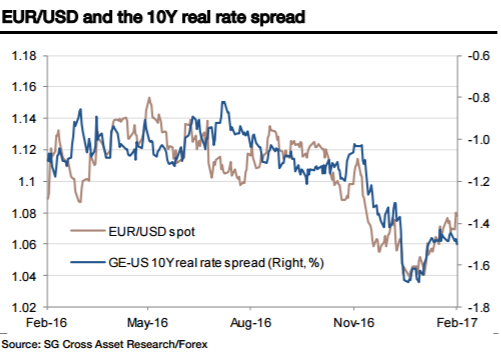

The Fed is expected to conclude its two-day policy meeting later today, but no changes are expected to be delivered in today’s communication. It is likely that we start seeing that the support that tightening measures usually have on yields and support for the relative currency, slowly start to fade especially if Trump team will actively pursue a weaker US dollar.

Gold as well has reflected the weaker US dollar yesterday. The yellow metal rose to session highs of $1215.20. Price is currently trading at $1209.06 it looks like the uptrend remains intact and TraderTip daily scenario envisages a possible rally towards $1219:$1222 as long as support around $1206 holds, and so far it has. However beware because if the expected daily highs are reached a pull back may be next to follow.