FX outlook. 0-3 months.

In the coming months, we expect EUR/USD to continue to trade in the ‘post-Brexit’ range of 1.10-1.1350. While political uncertainty is likely to cause higher volatility, we see little prospect of a big move in EUR/USD due to the outcome of the US election, as the political topics are more likely to have long-term than short-term implications for the US. As such, we see risks skewed to the downside in case the Fed hikes in December. The market is pricing around 55% probability of rate hike in December, suggesting that this should not be a big surprise. We expect that the potential rally in the USD following a US rate hike will be relatively shallow and short-lived. First of all, the pace of rate hikes will continue to be very shallow and secondly, investors are already very short EUR/USD according to the IMM data and EUR/USD tends to be less sensitive to relative rates when positioning is stretched, suggesting that the scope for a decline in EUR/USD might be limited. We target EUR/USD at 1.12 in 1-3M.

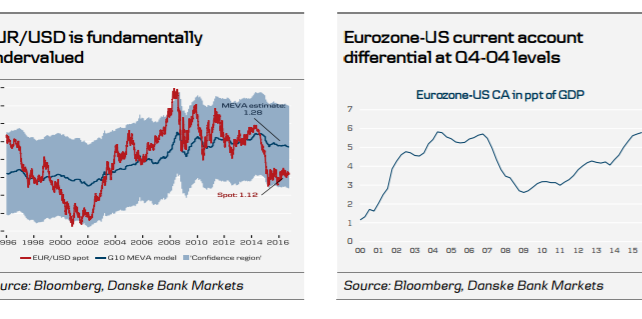

FX outlook. 3-12 months. We still expect the undervaluation of the EUR and the wide Eurozone-US current account differential to be longer-term EUR positives. Hence, we maintain our long-held view that EUR/USD will reach 1.20 before it reaches 1.00. We target 1.14 in 6M and 1.18 in 12M.

Copyright © 2016 Danske, eFXnews™Original Article