Barclays Capital FX Strategy Research notes that USD traders will focus on the releases of a round of top-tier US data on Thursday and Friday.

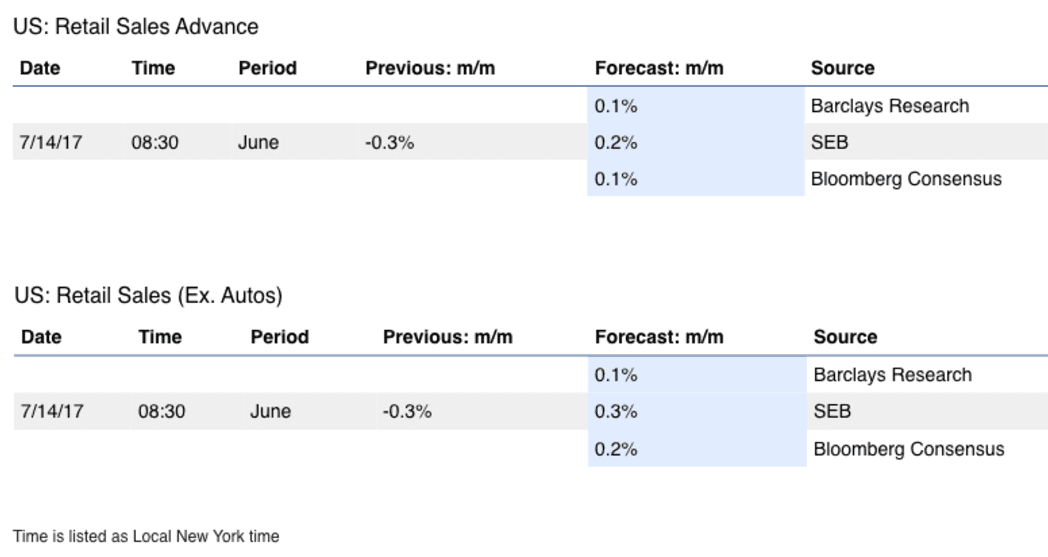

"The main prints will be June retail sales (0.1% m/m, core 0.5%), June industrial production and manufacturing (we expect a rebound to a modest 0.2% m/m), and U. of Michigan consumer sentiment (remain elevated but decline slightly to 94.0).

The USD has shown some asymmetric reaction to recent data releases. The markets seem to be looking through positive prints (ie. little reaction to ISM last week amid a weak ADP report, focus on weak wages in NFP) and focusing on data that could break the conviction of the Fed and delay normalization.

As such, the CPI data is likely to be the most important," Barclays argues.

Source: Barclays ResearchOriginal Article