Key Points

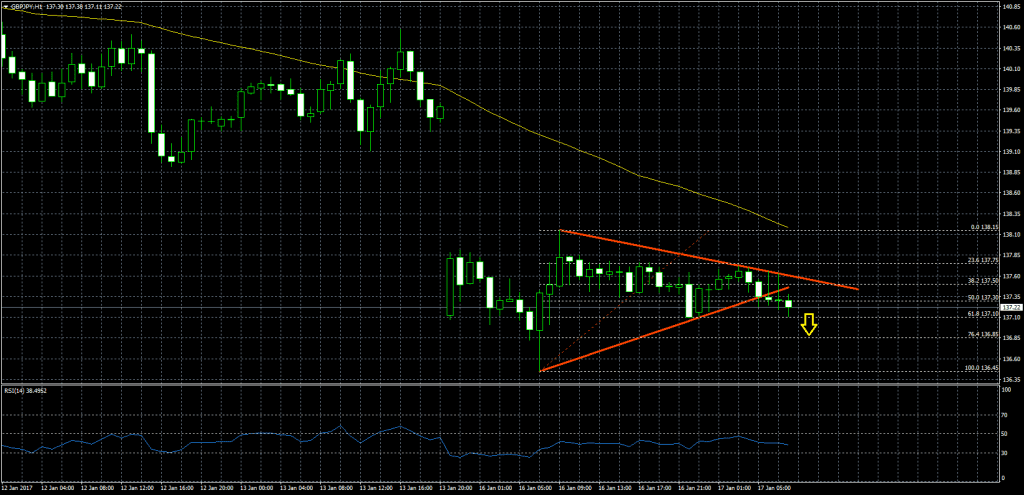

- The British Pound declined heavily this week against the Japanese yen and moved below 137.50.

- There was a contracting triangle pattern formed on the hourly chart of GBPJPY, which was broken at 137.30 for a downside move.

- Today in Japan, the Industrial Production figure was released by the Ministry of Economy, Trade and Industry.

- The result was in line with the forecast, as there was an increase of 1.5% in Nov 2016, compared with Oct 2016.

GBPJPY Technical Analysis

The British Pound opened this week lower against all majors including the Japanese yen, and traded towards 136.50. The GBPJPY pair traded higher, but failed, and now again moving down.

During the recent downside move, the pair broke a contracting triangle pattern formed on the hourly chart at 137.30. If the pair bounces once again, then the upper trend line may act as a resistance in the short term.

As long as the pair is under pressure, there are chances of more declines. A break below 137.30 may even call for a downside acceleration towards 137.00.

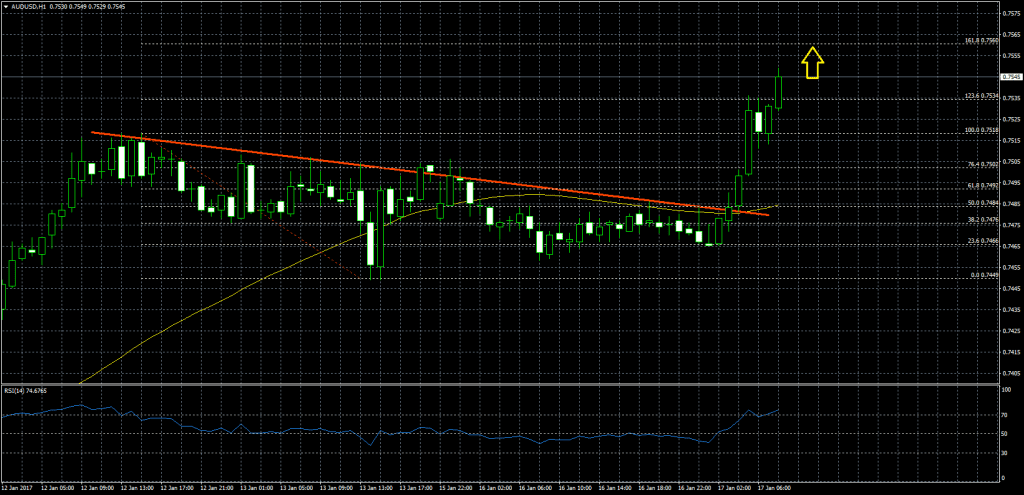

Australian New Motor Vehicle Sales

Earlier today, the Japanese Industrial Production, which measures outputs of the Japanese factories and mines was released by the Ministry of Economy, Trade and Industry.

The result around the market expectation, as there was an increase of 1.5% in Nov 2016, compared with Oct 2016. When we have a look at the yearly change, there was an increase of 4.6% in Nov 2016, compared with the same month a year ago. It was also similar to the last reading. So, it looks like the result was stable in Nov 2016.

Overall, the British Pound is likely to remain under a bearish pressure, and may trade towards 137.10-137.00 vs the Japanese yen.