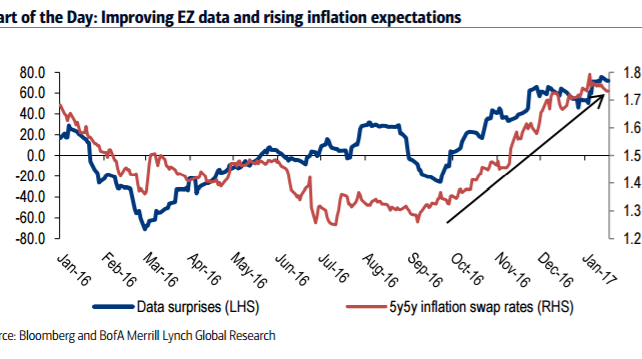

We expect Draghi this week to try to avoid any expectations on further policy changes. The dominant theme in Europe recently has been the acceleration in inflation and real economic activity (Chart of the Day), which ex post seems to justify the ECB's decision to scale back the pace of its purchasing and has led to calls to end QE early. We argue this is premature and that Draghi will likely stick to the December message.

On rates, we will focus on three issues: (1) how Draghi will react to the acceleration in inflation, (2) whether the ECB will disclose the implementation details of the new QE, and (3) comments on the repo squeeze over year-end and the lending facilities in place.

We see balanced and small EUR risks from the ECB meeting. In our opinion, the ECB is done with new policies for now. The FX impact from the meeting will depend to a large extent on Draghi’s rhetoric during the press conference. We expect him to be cautious and defend the December decisions, without providing new details or insights on what could come next.

We think any hawkish statements that strengthen the EUR during the Q&A could be an opportunity to sell EUR/USD again ahead of potential fiscal stimulus in the US.

EUR/USD has been a USD trade and weakened as the USD rallied after the US elections. The EUR has not weakened with respect to non-USD G10 currencies and has actually strengthened against the JPY. The EUR remains at its early 2004 level with respect to non-USD G10 currencies. Similarly, although the EUR/USD is down by 2.5% since the December ECB meeting, the EUR is down only by 0.4% with respect to non-USD G10 currencies.

In real effective terms, the EUR is stronger than in early 2015 (Charts 1 and 2). And EUR/USD has corrected higher so far this year, particularly in the last two weeks.

Copyright © 2017 BofAML, eFXnews™Original Article