As a preliminary gauge of sentiment we see that US equities closed in the positive on Friday, as equities apllauded news that Deutsche Bank was close to reachig a settlement with the US. Asian equities this morning took the positive handover and continued building on it.

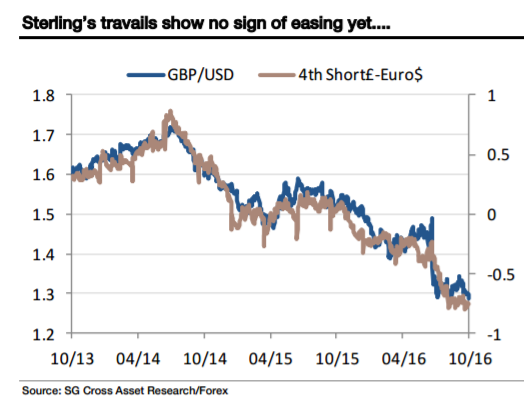

The Pound opened weaker this first trading day for October and the last quarter, as the Brexit process took a better shape when the British PM, Theresa May, announced the legislative changes allowing the Brexit will come into shape in around 6 months time.

Overnight we had the release of the Japanese business sentiment survey, the Tankan Survey. Overall actual data was very much in line with previous readings and at market open we saw the Japanese Nikkei higher and the JPY weaker as traders staged a relief rally, relief that numbers at least had not worsened.

In the currency markets the US dollar remains supported with the US Dollar index (DXY) gaining on the open and is currently at 95.55. Overall the JPY is weaker across its major counterparts however its losses so far remain in check up to the time of writing.

USDJPY is currently flat right were it opened at 101.42, TraderTip scenario for the day sees price action in the range between 100.80 and 101.82 but a drop below 100.26 would be very bearish.

On today’s economic docket we have EZ, US and UK PMIs for the manufacturing sector.