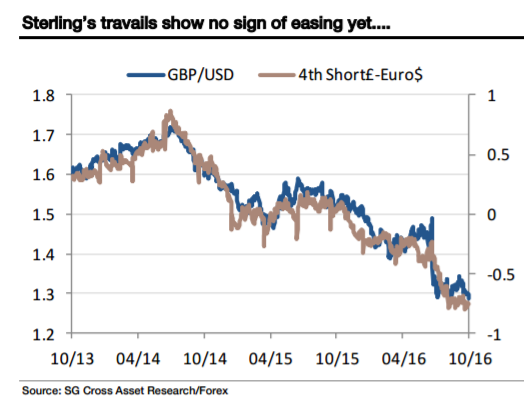

Confirmation that the UK Government plans to trigger article 50 by the end of Q1 2017 hit sterling harder than I expected yesterday, which given how much time I have spent blathering on about the risks to the pound is saying something. Some sort of a bounce is possible today but the noises from the Conservative party conference aren’t helpful. There will be fiscal slippage as the Chancellor won’t try to hit previous deficit reduction targets, but a significant easing is not on the cards. Nor is the government showing any signs of shifting a position where control on immigration is the hardest of lines in negotiations to leave the EU, and won’t be sacrificed or watered down in order to keep access to the single market, particularly for financial services. There’s nothing there to soften the outlook for sterling, at all.

f I extrapolate the correlation between GBP/USD and rates, GBP/USD 1.25 is reached if the market prices a 12-month forward rate differential of 1%. That will happen as long as the Fed is on track to raise rates at least twice by the end of 2017, and the UK is on track to ease at all. To get sterling below 1.20 we need the market to price much more Fed hiking, or the UK economy to be in poor enough shape that these simple rate/FX correlations break down. For now, our base case is still for a low of GBP/USD 1.23 in March.

*SocGen maintains a short GBP/USD position from 1.3750 targeting 1.25.

*This trade is recorded and tracked in eFXplus Orders.

Copyright © 2016 Societe Generale, eFXnews™Original Article