The US Dollar showed some signs of consolidation in these past two days after a week of declines. We are moving closer into the Nonfarm payrolls next Friday. Some weaker than expected data and the Fed’s sensitivity to such data has highlighted the importance of this high impact data.

ADP employment change, a proxy for Friday’s NFP, came out at 179K on Wednesday and the actual was stronger than the expected and the previous reading. The US Dollar index has managed to preserve the 95 levels ahead of the data next Friday – we are currently trading at 95.55.

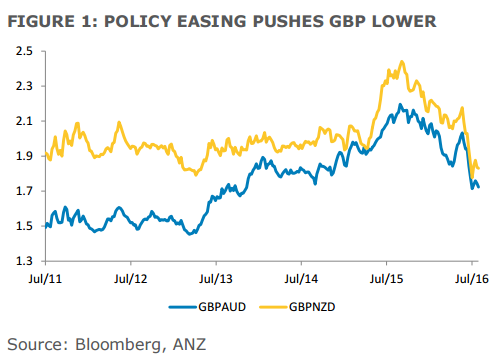

Sterling as well looks onto some important data later today, as we look onto the BoE rate decision. Consensus figures are pointing towards a rate cut this month. Sterling is licking its wounds after the massive declines seen in the aftermath of the Brexit vote but has managed to hold onto the current levels throughout most of July to date.

GBPUSD is currently at 1.3328 sticking to a 1.30:1.34 range so far.

Sentiment was largely positive as US equities turned green yesterday and oil recovered back some of the lost ground. Asia took the positive handover this morning and the major indices were mostly in positive.