The BoE announced a broad package of easing measures aimed at supporting growth and the anticipated transition in the economy following the decision to leave the EU. The BoE also shifted the horizon of its inflation target from 18-24 months to the longer term and will tolerate an inflation overshoot in the medium term (2-3 years) as the economy rebalances.

The announced package of measures was comprehensive and included.

– A 25 bps cut in Bank Rate to 0.25%.

– A new programme of private sector asset purchases with up to GBP10bn of UK corporate bonds.

– GBP 60bn increase in gilt purchases taking the stock of QE to GTBP435bn.

– A new Term Funding Scheme (TFS) to support the pass through of the bank rate cut to borrowers.

Whilst the UK is somewhat of a special case at the moment, for financial markets, the easing reinforces the theme of super low interest rates. Governor Carney did say that he is not a fan of negative interest rates and that the UK’s lower bound lies just above zero.

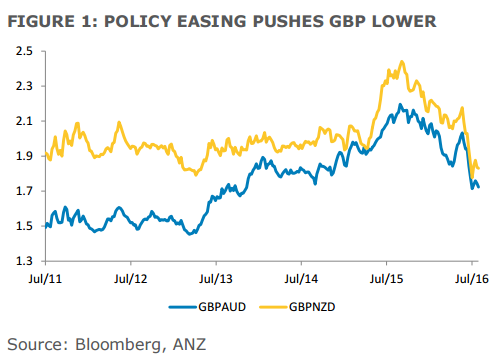

But the move adds to the global super low interest rate complex and should continue to support demand for higher yielding assets. That implies ongoing GBP underperformance against the AUD, NZD and Asian currencies.

The implication for the euro area are less clear, but the forthcoming cycle of referenda and elections, and the associated uncertainty that brings, suggest that policy will err on the loose side and that may weigh on the euro.

Copyright © 2016 ANZ, eFXnews™Original Article