We expect no change in Bank of England (BoE) policy this week. We also drop our forecast for a rate cut and QE extension in February. Resilient official growth makes stimulus harder to justify and QE seems politically unacceptable now.

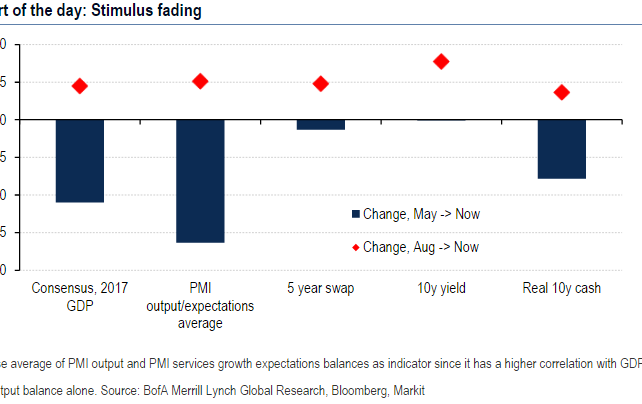

We still think the outlook warrants further easing, however, and therefore expect the BoE to return to the table later in 2017. The monetary stimulus in the system has been fading (Chart of the Day). True, GDP forecasts have been improving and real gilt rates remain lower than May. But, the former is mainly due to base effects from 2016 rather than the outlook while longer-term household real rates have fallen little. We look for another rate cut to 10bp in August rather than our previous call of February.

The GBP consolidation that we have longed called for is likely to continue into year-end and may extend into the start of 2017 depending on the outcome of the Supreme Court Appeal on Article 50 and further potential legal action, which may delay the triggering of A50. The irony of the current situation facing GBP is that the political uncertainty we highlighted as a GBP negative immediately following the EU referendum is now precisely the reason why sterling is outperforming. The path to Brexit is not the smooth process that most had believed as the legal hurdles towards the triggering of Article 50 in 1Q continue to mount.

We doubt that this week's MPC meeting will meaningfully shift the dial for GBP as we head into a crucial and volatile quarter for the Brexit process.

Copyright © 2016 BofAML, eFXnews™Original Article