EUR/USD – NEUTRAL BIAS – (1.1150-1.1450)

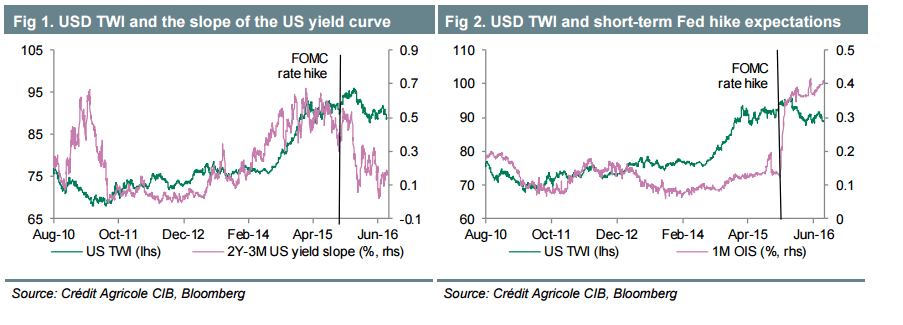

The performance of the US dollar in the week ahead will be dictated by the market’s interpretation of Fed Chair Yellen’s speech at Jackson Hole.

We believe that Fed Chair Yellen is unlikely to explicitly signal that the Fed plans to resume rate hikes in September although it will be left open as a “live” meeting dependent on the incoming economic data. It could prompt some initial relief weighing on the US dollar.

However, the negative impact on the US dollar should prove limited with the market already discounting hardly any further tightening in the coming years. In contrast, there would be a much larger market adjustment if Fed Chair Yellen encouraged the market to price in a higher likelihood of a September rate hike which would provide more support for the US dollar in the near-term.

The recent direction of EUR/USD has been mainly driven by broad-based US dollar weakness although the easing of Brexit fears is also helping to offer support for the euro. The euro-zone economy has been little impacted so far by the Brexit vote reducing the need for the ECB to announce more easing as soon as in September.

Copyright © 2016 BTMU, eFXnews™Original Article