Key Points

- The Euro made a downside move recently and traded towards 1.1340 against the US Dollar.

- There is a major bearish trend line with resistance at 1.1365 forming on the hourly chart of EURUSD.

- Today in the Euro Zone, the PMI service for June 2017 was released by the Markit Economics.

- The outcome was above the forecast, as there was a rise from the last reading of 54.7 to 55.4.

EURUSD Technical Analysis

The Euro was under a minor bearish pressure this week and made a downside move to trade towards 1.1340 against the US Dollar. The EURUSD pair broke the 1.1400 support and the 21 hourly simple moving average during the downside move.

The pair traded as low as 1.1339 and currently correcting higher. There is a major bearish trend line with resistance at 1.1365 forming on the hourly chart.

The trend line resistance along with the 21 hourly simple moving average and the 23.6% Fib retracement level of the last decline from the 1.1452 high to 1.1339 low are acting as a hurdle for an upside move in the short term.

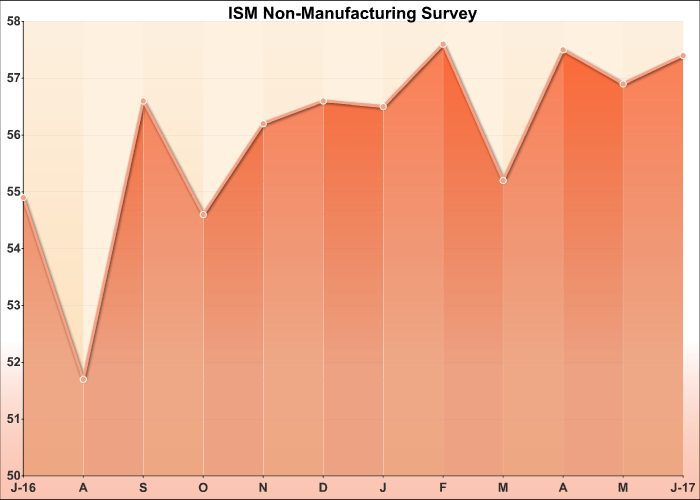

Euro Zone Services PMI

Today in the Euro Zone, the PMI service for June 2017 was released by the Markit Economics. The market was positioned for no change from the last reading of 54.7.

The actual result was above the forecast, as there was a rise from the last reading of 54.7 to 55.4. The report stated that:

The expansion was again led by the manufacturing sector, where production rose to the greatest extent since April 2011. Although the rate of growth in service sector activity moderated, it was still among the strongest seen over the past six years.

Overall, the EURUSD pair may correct a few pips, but remains at a risk of a downside move below 1.1350 in the near term.