Major equity indices were mostly heading lower during the asian session, changes were however marginal so far. The highlight in Wednesday’s economic docket was for the Fed’s release of the latest FOMC meeting minutes.

Minutes mainly focused on the impact of rate hikes on the markets, and on when the unwinding of the Fed’s balance sheet should start. Market analysts are expecting the unwind to kick off in the last quarter and next rate hike to be around December.

In its briefing note to the G20 countries, ahead of the end-of-week summit, the IMF highlighted some of the risks facing major economies. Most prominent were the IMF’s comments on the US economy, namely that its withdrawal from global trade and delays in Trump’s proposals will likely continue to impinge on the rate of US economic growth.

The IMF also warned about the risks and vulnerabilities posed by the world’s second largest economy, China, mentioning the risks brought about by the debt and uncertain monetary policy. On the other hand the IMF positively noted positive forecasts for the EZ, Asia and Emerging Markets.

Lagarde acknowledged that there is momentum but reiterated that the risks to higher growth needed to be closely watched.

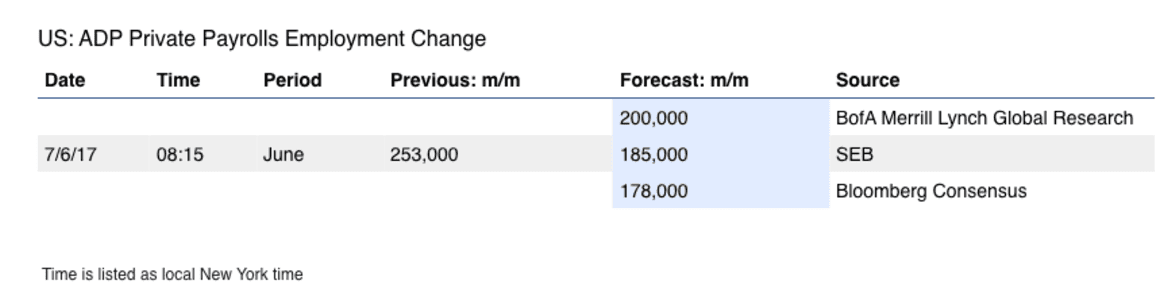

The USD remained on the defensive, with the US dollar index finding resistance around the 96.35 handle. The USD is currently walking a fine line as it deals with rising geo-political tensions and the important developments in its monetary policy. In addition tomorrow’s NFP data will likely be used to give further endorsements (or not) to the Fed’s current tightening policy.