Fundamental Forecast for Euro: Bearish

Euro Weakness Ensues Despite Stronger 2Q’13 GDP; Pound Up on BoE, Jobs

Improving Growth Prospects Support EUR/CHF Gains

US Dollar Sentiment More Mixed as Traders Ease Extreme Euro Bearishness

The Euro finished in the middle of the pack this week, posting neither gains nor losses in excess of +/-1.30%, as the week can largely be described as a wash for the major currencies covered by DailyFX Research. Heading into this past week, the question to be answered by the Euro was: ‘Will further signs of improving growth help bolster the Euro?’ Indeed, as noted in this article last week, the Euro failed to post meaningful gains and continues to struggle despite signs of recovery emerging in both the core and the peripheral Euro-Zone.

Even though the EURUSD only fell by -0.10% (to $1.3329) while the EURJPY added +1.26% (to ¥130.00), it is clear that the upswing in regional data isn’t boosting optimism for the single currency, at least as much as it is for the British Pound, which has emerged as the top performer in August (the Sterling was the best performer this week, adding +0.94% against the Euro).

The continued lack of bullishness amid what should theoretically be very supportive data is concerning insofar as other asset classes but for the Euro are responding, making the Euro especially vulnerable to any negativity that hits the newswires. On Friday, August 16, the Spanish-German 10-year bond yield spread fell below 250-pips for the first time since August 2011, but the Euro barely budged; in years past, tightening of this spread (via softer Spanish yields) was viewed as a bullish catalyst for the Euro.

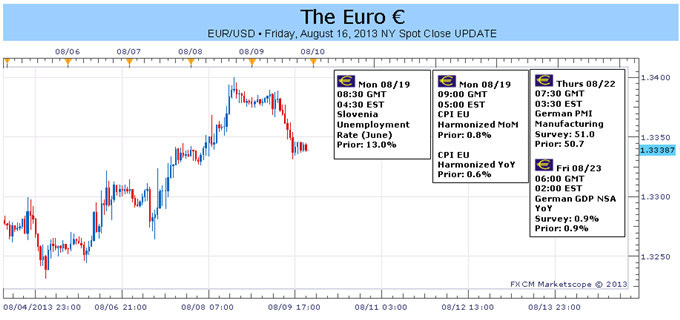

With several important data points in the rearview mirror that point to a nascent recovery, if the Euro is to stay afloat (truly the best way to describe price action in EUR-based pairs in August), then additional data showing that the economy is performing in excess of the collective market’s expectation needs to hit the wires (at the absolute minimum). This week, such an opportunity exists with several “medium” importance events due, according to the DailyFX Economic Calendar.

Of note, the preliminary August PMI surveys for Germany and the broader Euro-Zone will be released on Thursday, and will be the prime fundamental/event risk catalyst Euro traders should look to for increased volatility. Generally speaking, PMI figures across the region – from Italy, to Germany, to Spain – have been improving. The PMI surveys are viewed as a strong proxy and leading indicator for GDP; and the continued hold in the gauges above 50.0 would indicate modest growth conditions are setting in.

Once more, with clear signs that “green shoots” are emerging in the Euro-Zone, we are not looking the actual data but rather the reaction to the data; if the Euro is indeed shrugging off improved growth prospects (“priced in”), then further confirmation of the nascent growth picture shouldn’t do much by way of supporting the Euro. Should the PMI figures miss, the catalyst behind recent Euro-Zone optimism will have been removed, and a weaker Euro should emerge. –CV

— Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx