Fundamental Forecast for Euro: Neutral

– Regional PMIs showed further improvement…but for in France.

– Rising US yields add to EURUSD pullback.

– The Euro sees first major setback versus commodity currencies in weeks.

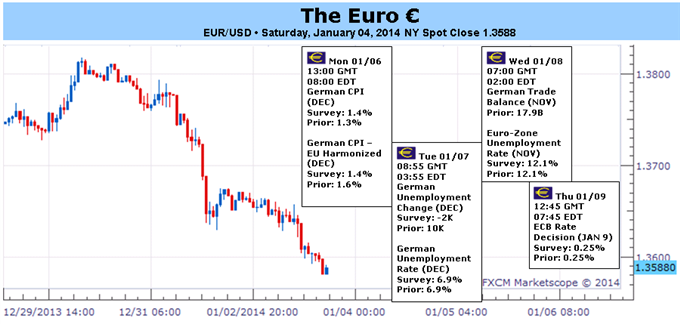

The Euro started off 2014 with a bang, though not of the celebratory kind: after hitting as high as $1.319 at the start of the week (in 2013), the EURUSD closed at 1.3589. So, even though the EURUSD fell by -1.16% from open to close over the course of the week, in reality, it was -1.66% off of its highs, in price action similar to late-October/early-November. It is due to these similarities that we see the Euro’s first real test of 2014 coming up this week.

In October, just ahead of the November European Central Bank policy meeting, a round of the weakest inflation data in the post-2008 crisis era prompted fears of further accommodative policy action in the immediate future. In turn, in the days leading up to the ECB meeting, the EURUSD fell by over -3.5%, and those fears were ultimately vindicated as the ECB cut its main refinancing rate to a historic low of 0.25% this November. (It is worth noting the ECB meeting marked the November low for the Euro.)

This past week, the round of European PMI Manufacturing data for December due out on Thursday provided the catalyst to start the leg lower. To be clear, the December Italian, German, Spanish, and the broader Euro-Zone PMI Manufacturing figures remained or moved further into growth territory (>50). For most of the Euro-Zone’s major economies, economic conditions are improving slowly but surely. But concern arose after the French report showed the weakest reading in seven months and an outlook that looked disastrous for future business and employment.

This may be a short-term panic based around a policy crisis in France. If the French economy is suffering under current leadership, leadership that is unlikely to change in 2014, then neither will the current obstructive economic policies change, and market participants have no other choice but to turn to the ECB for help; as it stands none will come domestically in France.

Help from the ECB is unlikely presently, and therefore, any declines seen in the Euro resulting from speculation that more accommodation is on the way could be unwound. As rate changes typically take around six months before the November cut effects are felt through the economy, we find it unlikely that, in absent of a further increase in deflation/disinflation figures, the ECB will cut rates again, at least in the 1Q’14.

The November policy decision made clear the ECB’s intent to shape policy solely around Germany (otherwise the main rate would have been cut months earlier). Without German monetary indicators pointing towards deflation, other easing policies – another rate cut, another LTRO – are highly unlikely. It is important for Euro bears that German data, more so than any other country, continues to remain under pressure. This manifestation is unlikely to occur, with the December German CPI report (on Monday) expected to show inflation at +0.4% from +0.2% (m/m) in November.

Ultimately, if the ECB announces a FLS-like LTRO, it could prove supportive for the Euro. Absent a massive carte blanche liquidity injection like LTRO1 and LTRO2 in December 2011 and February 2012, respectively, measures geared specifically towards faster employment growth, a rebound in the housing market, and a healthier consumer should limit Euro weakness. The ECB is likely to have a very limited scope for easing in the 1Q’14, giving the Euro ample opportunity to appreciate further. Near-term selloffs may be viewed as longer-term buying opportunities at present time. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx