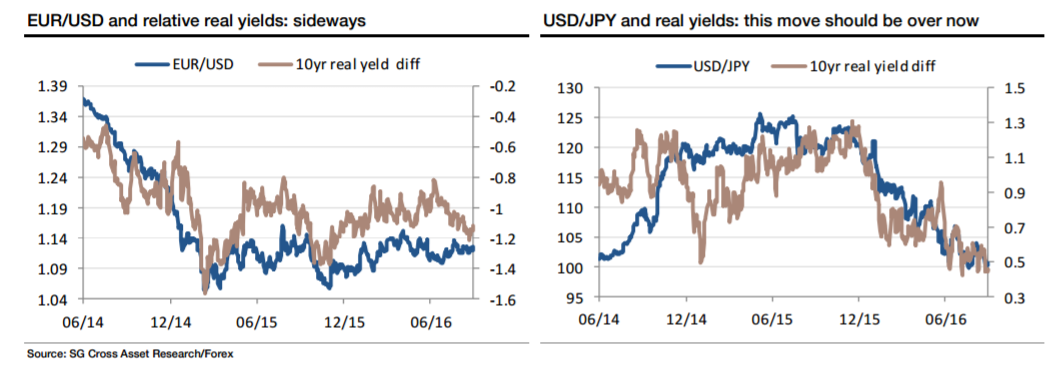

A base case for the EUR/USD outlook starts from the premise that the rough correlation between FX rates and relative real bond yields will persist. Since early this year, a range for relative 10y real yields of -80bp to -140bp has kept EUR/USD in a 1.08-1.14 range. It would take a rise in 10y TIIPS yields to above 30bp, where they were in 1Q, for EUR/USD to have any chance of getting to the bottom of that range. Even then, Bund yields would need to remain anchored.

After another frustrating week, when, despite OPEC agreeing to production cuts and Fed officials working hard to point the market towards a December hike, 10y nominal US yields are still below 1.6%, and it’s hard to get excited about shorting the Euro.

Maybe we’re just in for a long period of going sideways. But I have two more sources of concern, which may argue for Euro longs, against GBP* now and against the yen before long. EUR/JPY is attractive because while USD/JPY is equally sensitive to 10y real yield moves, there’s less upside risk to 10y JGB yields, particularly adjusted for inflation, and the Fed is less sensitive to USD/JPY than EUR/USD, given their relative importance in the TWI baskets.

The first source of concern for Euro bulls is that if the ECB worries that a low, flat yield curve is unhelpful for the financial sector, or that the share of the government bond market it owns is getting too high, or feels limited by super-low yields, these are all reasons to shift the policy focus towards more TLTROs and similar policies, which would help beleaguered southern European economies more in any case. Add in the possibility that the German government adopts easier fiscal policies, and there would certainly have little reason to buy the long end of the European yield curve.

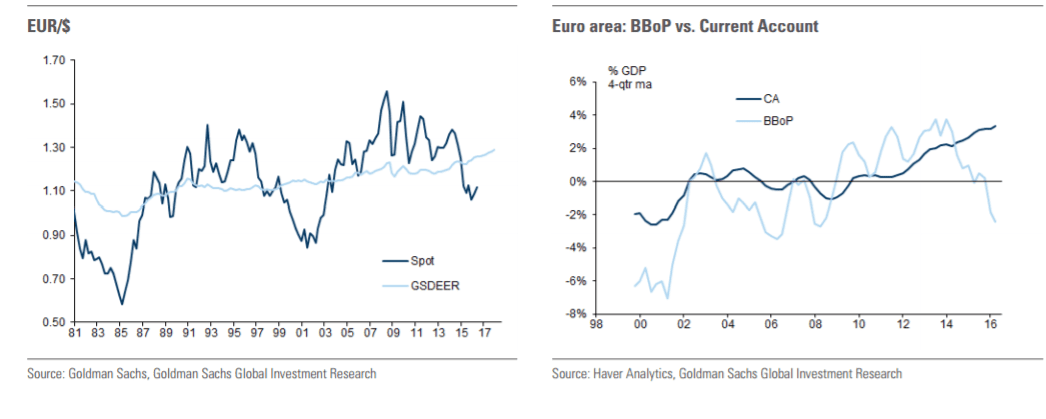

The second risk is that the outflows of capital from Europe due to the ECB anchoring all government bond yields are no longer weakening the Euro. They are merely keeping it stable. European investors have bought €400bn in foreign bonds in the past year, but if this is no longer weakening the Euro, does that mean that a slowdown in the pace of outflows (due to QE tapering, perhaps) could trigger a sharp currency rally? The Euro area economy, its governments and its central bank face many challenges, so it may still be too early to be a Euro bull. But some of the risks ahead are already priced in, and the longer the Euro refrains from depreciating, the greater the risk of a damaging spike higher.

*This trade is recorded and tracked in eFXplus Orders

Copyright © 2016 Societe Generale, eFXnews™Original Article