The dollar struggled near 6-week lows against its rivals on Wednesday as rate hike expectations were pushed back further given recent sluggish data.

The dollar's weakness mirrored a sluggish session on Wall Street overnight, with indexes suffering their worst day in roughly a month in the wake of unconvincing economic data and falling oil prices. Shares closed lower Tuesday as WTI crude oil settled below $40 for the first time since April and the Dow closed lower for the seventh straight day. Nasdaq snapped a five day winning streak.

US consumer spending rose but the markets focused more on Tuesday's lackluster inflation numbers. Market particpants expect the weak business investment and the second quarter's anemic economic growth rate, could encourage the Fed to keep interest rates at current low levels for a while.

EUR/USD was little changed at 1.1212 after gaining 0.6 percent overnight to touch 1.1234, its highest since the Brexit referendum.

USD/JPY traded just below 101 after it had bounced 0.3 percent overnight to 101.195. It slipped 1.5 percent the previous day to a 3-week trough of 100.680, amid some disappointment that a Tuesday meeting between Japanese Finance Minister Taro Aso and Bank of Japan Governor Haruhiko Kuroda did not result in steps to weaken the yen.

The Japanese cabinet approved 13.5 trillion yen ($132.04 billion) in fiscal measures with cash payouts to low-income earners and infrastructure spending. The yen, however, strengthened against the dollar after the announcement.

With the dollar's weakness, the Australian dollar got a breather, despite an interest rate cut by the Reserve Bank of Australia. AUD/USD climbed 1 percent overnight to a near 3-week high of 0.7638. The Aussie last traded below 0.7600, slightly lower on the day.

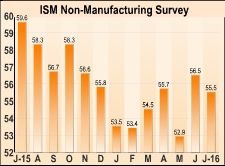

Forex traders will await the July U.S. ADP private employment report and Institute for Supply Management (ISM) U.S. non-manufacturing activity data due later in the day for immediate cues.